The ECB in a Limbo

The ECB is in a limbo: neither Paradise, nor Hell and not even Purgatory. The risk of persistent deflation is small, even if lower oil price could bring again occasionally inflation into negative territory. However, the prospect of reaching price stability at around 2% is far from sure and further into the future. Currently, the underlying, quasi-philosophical question is whether 1%, which is the level around which core inflation is hovering, is acceptable or not. In a way, without admitting it, the question of principle is whether the definition of price stability chosen by the ECB (close to but lower than 2%) should be revised or, at least, whether it should be understood with asymmetric flexibility, whereby 1% is good enough but 3% is too much. I see no prospect of this principled discussion being concluded with an agreement. Indeed I do not even think it will be explicitly conducted. Still, different views about it will continue to serve as intellectual background for hawks and doves alike.

The next rendezvous for a substantive policy discussion, in which, however, the question of principle will again not be explicitly addressed, will be in March, when the ECB macroeconomic projection for 2018 will be published. Inflation projections for 2018 will probably become the new critical issue around which the discussion will be articulated. Should they confirm, as it is more likely than not, the approach, albeit belated, to 2%, the hawks will press for a policy pass even if the regain of “below but close to 2.0%” will be postponed from 2017, confirming the “downside risks” mentioned in the monetary policy account of the December 3rd meeting. The doves, instead, would stress two points: first, that the length of time over which the ECB is failing to achieve its inflation target is getting longer and longer and this has a negative effect on its credibility; second, that the repeated over-optimism in the ECB projections about inflation casts a doubt on the expectation to get back close to 2.0 even in 2018. The balance between doves and hawks is difficult to predict and will, in any case, be influenced by economic news between now and the next Council meeting. As of now, also taking into account the modest decisions of the last meeting, in which there was not really much pressure for stronger measures, I see a slight prevalence of the hawks. It is only in the unlikely case that the 2018 inflation projections would show that not even in 2018 the 2% bar is approached that we would definitely have more monetary easing.

The background to the discussion in December, on which Draghi may report in his press conference will be characterized by the following aspects.

First, economic activity is moving along at decent pace. Indeed we are probably seeing the obverse of the stagflation of the seventies: over then the oil price upward shock caused at the same time inflation and stagnation, creating a dilemma for central banks. Now the oil price downward shock is supporting activity while pushing inflation down. There is less of a dilemma situation right now because activity recovery remains quite moderate and there is definitely no evidence of overheating. In addition the sharp fall in the price of oil is making some investment, in energy saving and alternative energy sources, uneconomical, destroying, so to say, capital

Second, the repair of the banking system, and therefore the supply of bank credit, is improving as the last post documented.1 The improvement is visible both in more lending at more favourable conditions at the aggregate €-area level and in a gradual surpassing of the divide between periphery and core.

Third, China deserves much attention, but is not enough to trigger a policy change right now. I think the ECB, as the rest of the world for that matter, is looking with bated breath at the attempt of the Chinese government, or to be more precise of the Chinese Communist Party, to achieve a not too rough transition from an industry-investment-export model to a service-consumption-domestic demand model. At a deeper level, my own question is whether we are not seeing the first signs of a denouement, with unforeseeable consequences, of the centaur nature of China, with a capitalist body and a communist head 2.

Fourth, equity losses will be discussed by the Council, but I do not see that they will be upgraded from their secondary role in ECB deliberations.

Fifth, on the € exchange rate I think there is nothing much important to notice.

Sixth, I do not expect any move in January because the move in December is too fresh to consider another one, notwithstanding the disappointment created by the timid moves at the last meeting .

Finally, the fact that the historical, tightening step by the FED went smoothly, both operationally, as I will discuss in a minute, and more generally, is one more reason for staying put in December.

So my expectation is that Draghi will re-confirm the willingness to do more if needed, with the need again defined by the prospects of getting back to price stability (2%). But will refrain from anything more specific than this. March is the next important date when a further rate cut and a possible increase in the monthly purchases could be considered. At a certain point in the future also something will have to be announced about tapering, as I do not believe QE will move from 60 billion to 0 from one month to the other. A hint in this direction is contained in the monetary policy account. But any announcement in this area will be delayed much further in the future, as any talk of tapering would be considered an anticipation of exit from QE.

On the FED, after waiting for so long, my sense is that eventually the rate increase went out quite smoothly.

In economic terms, the market accepted the point made by Yellen, that one should not overstate the importance of the first increase but rather look at the future succession of rate increases that, she assured, will be moderate and consistent with economic, in particular inflation, prospects. Indeed one could say that the market over-accepted Yellen´s message, as it is expecting fewer than the 4 increases in 2016 that the FED pencils in. The events since the decision in December confirm the view of the market that rate increases will be very gradual, if indeed they will come at all in the next quarters.

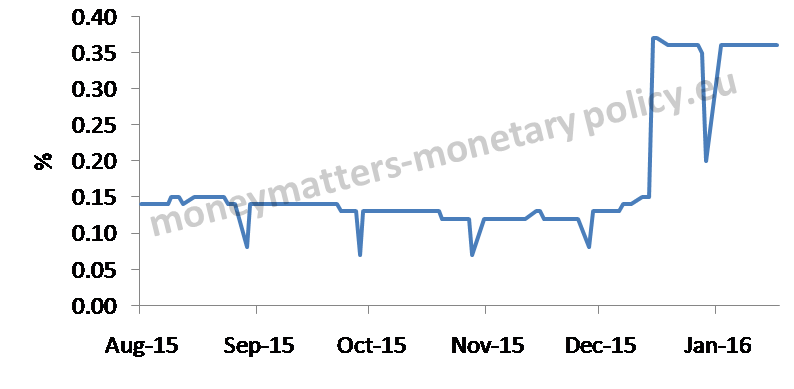

In operational terms the Fed seems to have been able to shift up the Federal Funds Rate by something very close to the 25 bp rate increase and keep it relatively stable with a moderate size of O/N Reverse Repos (RRP) (Chart 1).

Chart 1. Federal Funds rate

Source: FED

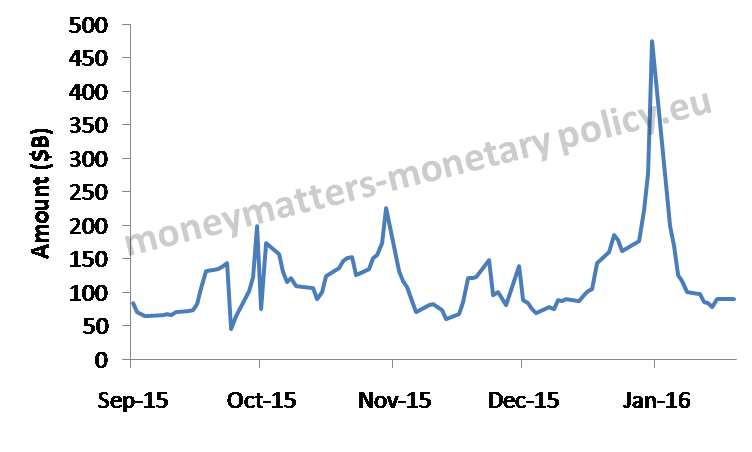

Indeed, while the FOMC had suspended the aggregate cap on overnight reverse repurchase transactions, which would have in principle allowed the desk in NY to carry out operations up to 2 trillion dollars (the limit being the amount of securities that the FED could use in the RRP), the amounts were fairly limited. (Chart 2).

Chart 2. Size of RRP operations

Source: FED

The story does not seem to be completely over, however, as Yellen announced that: “we are engaging in a project at this time to consider what our long-run operating frameworkshould look like.” But this seems to be a long-term issue with no immediate consequences.

For the time being the FED is on a corridor approach, like the ECB, but with different characteristics. Since different institutions have different kind of access to FED facilities (banks to Interest On Excess Reserves (IOER)/non banks to RRP) and in the presence of excess liquidity and limited arbitrage between IOER and RRP, the corridor is between the plafond, i.e. the IOER, and the bottom, the RRP rate, of the corridor. So, currently, between 25 and 50 bp. In the first weeks since the increase, the Federal Funds rate has settled around the middle of the corridor. In the ECB, instead, the corridor has been more or less compressed to the deposit facility rate and EONIA is close to the bottom of the corridor. Another potential difference is that the position of the Federal Funds Rate between the IOER and the RRP rate depends on the arbitrage between the two rates carried out by banks (in particular foreign banks) and thus may be more difficult to control by the FED, while in the ECB setting it is just the weight of the huge excess liquidity that is keeping EONIA close to the deposit facility rate. Beyond these differences in the functioning of the two corridors, there is a more basic difference: the ECB corridor is between a deposit facility and a lending facility (the Main Refinancing Operation) while the FED corridor is between two deposit facilities, one for banks and the other for non banks.

This post was prepared with the assistance of Madalina Norocea.

- Yes, bank credit supply is improving in the €-area [↩]

- I talked about this possible denouement in a previous post: When will it be “1989” in China? [↩]