My take of what could happen between Greece and its creditors.

A lot of uncertainty surrounds developments between Greece and its creditors. The outcome is potentially ruinous for Greece while I take little comfort from the fact that the waves of pessimism and optimism coming for Greece have had so far limited impact on developments outside Greece, and in particular on the peripheral countries of the €-area. I agree with the observation that the ability of the €-area to withstand a Greek shock is better than, say, 2 years ago and I also see the possibility that Grexit could lead to enhanced cooperation between the remaining members of the €-area, to stress that Greece is a unique case and attenuate the consequences of Grexit. However this does not make me confident that the shock would be limited: attenuating a catastrophe is different from avoiding one.

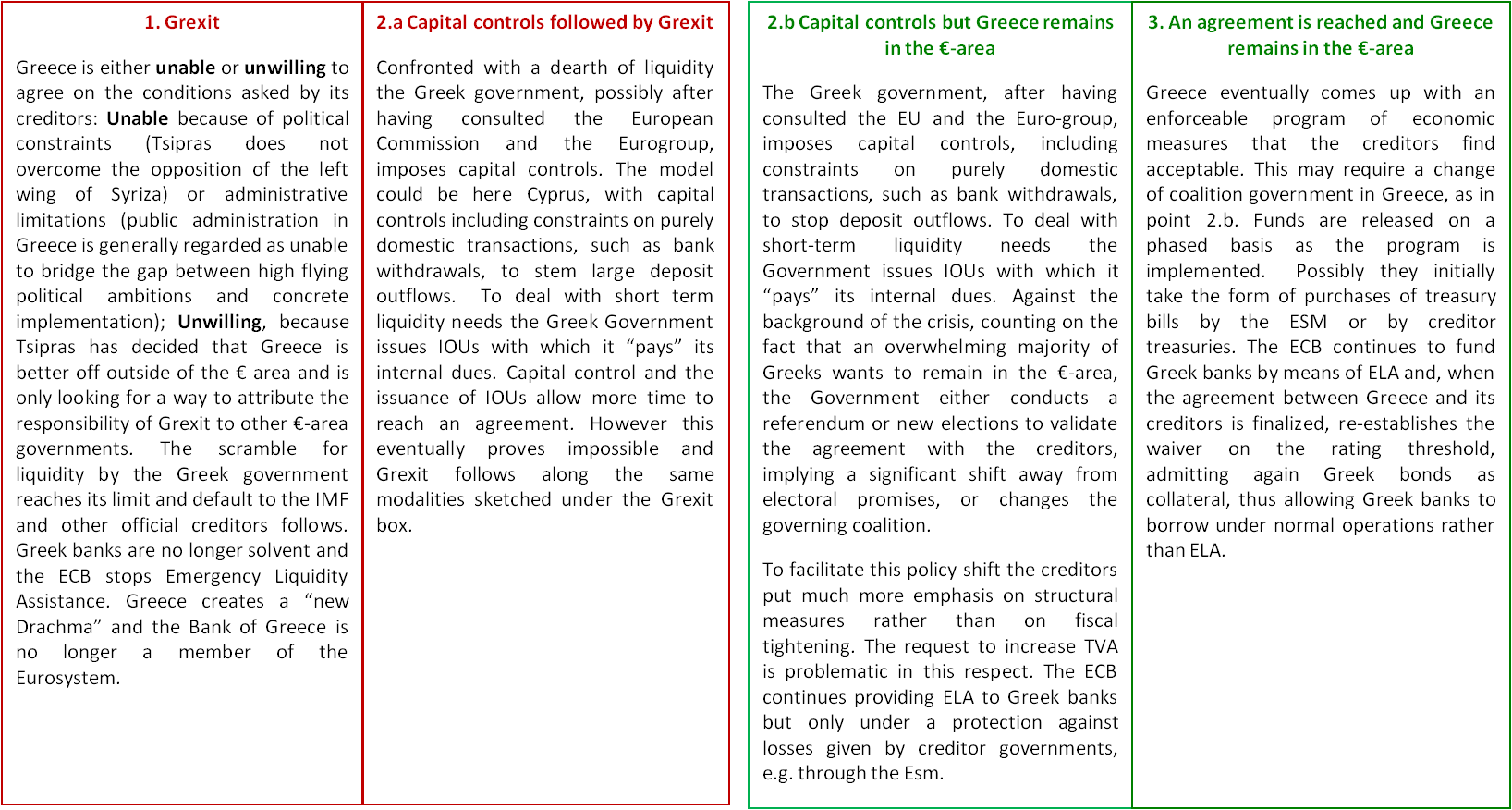

To visualize the different developments that could take place and their probability I have designed the following tree-chart. (If you need it, click on the figure to zoom on it.)

Interesting. However, in Grexit scenario, Greece could not create its own new currency, such as a new Drachma, unless it decides to withdraw not only from EMU but also from EU. Since monetary sovereignty, intended as the power to issue the legal tender within the EU, is statutorily assigned to the ECB by Member States, it would be impracticable for a Member State to recoup such a power without contemporarily rejecting the EU Treaties and, in particular, the provisions conferring exclusive mandate to the ECB on monetary policy. Thus, if Tsipras wants to issue a new legal tender, this could be done only by a decision of the ECB which has exclusive power on the issue (art. 128. TFUE). The Greek Governement and the Bank of Greece cannot do anything about it. Otherwise, the only other option available to Greece is putting itself out of the European Union and, then, recoups its own monetary sovereignty, although the costs of such a withdraw for the Greek economy would be overwhelmingly serious.

I agree that from and institutional and legal point of view things are very complex and I had no pretence of covering them in my short post. The complexity of the legal situation is one of the factors, albeit not the most important, that make any form of Grexit such a momentous event, first for Greece but also for the rest of the €-area. This is, at the same time, a strong incentive to avoid Grexit. This is the reason why, notwithstanding the apparent lack of progress in the negotiations, I still see he maintenance of Greece in the €-area as twice as likely as Grexit.