Central banks: from omnipotence to impotence?

The President of the ECB Mario Draghi has been clear, both at the last press conference and in front of the European Parliament on February 15, that the ECB is determined to achieve its price stability objective, defined as inflation below but close to 2.0 per cent in the medium term.

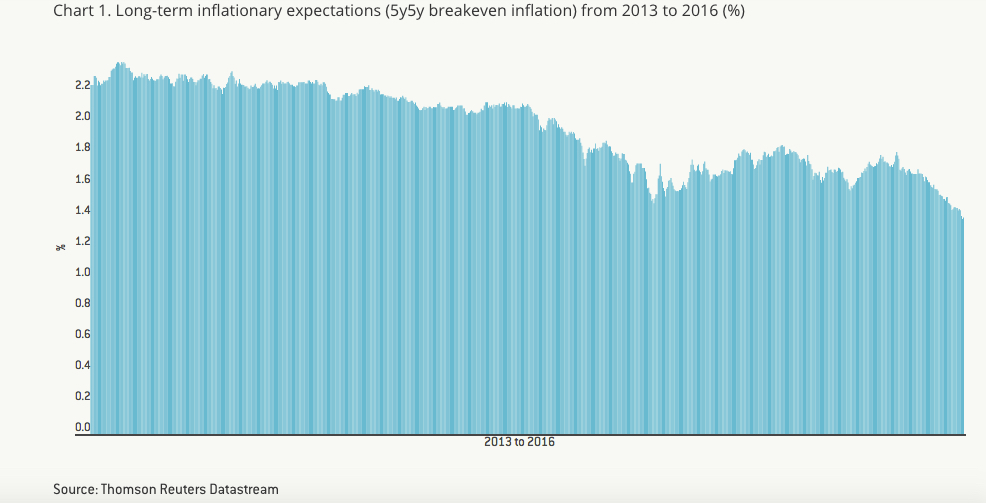

The markets do not seem overly impressed by this determination. Inflation is expected to remain below the ECB’s objective, even in the long term, as seen in Chart 1, which shows the inflation expected for a period of five years, five years in the future (the so called 5y5y breakeven inflation), which is just 1.4 per cent. Breakeven inflation, meanwhile, is only at 0.6% for a five-year horizon.

However, the gloomy prospects for price stability in the euro area are qualified by two considerations.

First, inflation expectations, as derived from inflation swaps, are being implausibly pushed down by the current low oil price, even in the medium to long term.

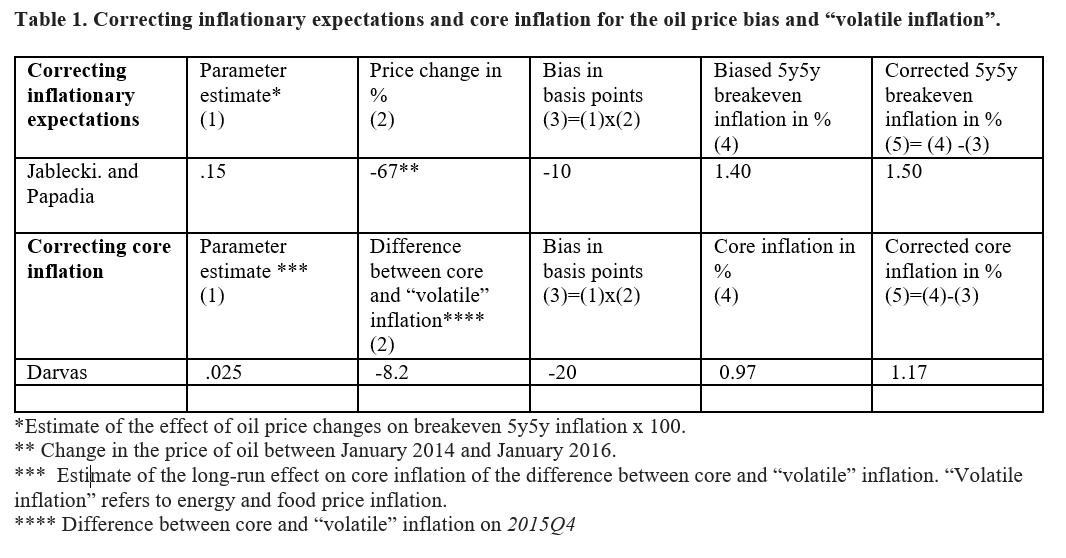

This means that market-derived inflationary expectations are biased downwards. We can try to correct inflationary expectations for this bias by estimating what the level of inflationary expectations would be if the price of oil had remained constant. This assumes that “true” inflationary expectations are obtained by eliminating the estimated effect of the fall of oil prices on inflationary expectations.

The results of this correction are reported in the upper part of Table 1, using estimates by Jablecki and Papadia. The estimated correction amounts to 10 basis points, not insignificant but not decisive either.

Second, Zsolt Darvas has shown that to obtain an estimate of what the rate of inflation would be if the price of energy had had the same increase as that of core inflation, it is not sufficient to subtract the price of energy from the consumer price index: one also has to take into account the impact of the changes of the price of energy on other goods and services.

According to Darvas’ estimation, core inflation is a bit higher (20 basis points) than simple core inflation when fully adjusted for “volatile inflation” like energy and food.

Even taking these corrections into account, we cannot confidently expect that inflation will reach the ECB’s objective without additional measures, even in a generously-defined “medium term”. Even Draghi does not appear to expect inflation to hit the target, as he has hinted at new measures in March.

The question is which tools remain at the ECB’s disposal, and how effective they are. The Governing Council of the ECB seems confident. The latest monetary policy account reported that “the Governing Council was willing and able to take further monetary policy action, if warranted, reaffirming that the Governing Council had a broad range of instruments and tools at its disposal.”

We see essentially two tools that the ECB is ready to consider (2): more QE and further cuts in interest rates in the negative domain.

We look at what “more QE” would mean in practice,(3) how much the ECB could further lower interest rates, and what the balance is between the risks and effectiveness of these possible measures.

More QE

We have most probably entered an area in which QE, as currently designed, has a decreasing marginal effect. There are two reasons for this.

First, we have seen this development in the different waves of QE in the United States. If we measure the effect of central bank purchases by means of the reduction of the yields on Treasuries for a given amount of purchases, there is evidence that the impact of subsequent QE waves decreased over time(4).

Second, the ECB announcement in December, that net purchases would be extended to at least March 2017, and that the reinvestment policy would add about €680 billion in liquidity to the system by 2019, amounting to about two-thirds of the original size of the expanded APP as decided in January 2015”, disappointed markets, as shown by the appreciation of the euro and the fall in equity prices.

With the start of the QE program, the difference in yields between bonds with 10 years and 1 year maturity, the ‘term spread’, increased, as shown in chart 1. This was driven by an increase in 10 year yields.

An explanation given at the time was that inflation expectations had increased thanks to QE, but the spread subsequently fell again. It is now roughly 0.5% above the pre-QE level. No visible change appeared after the announcement that the QE program would be prolonged.

Note: the term spread for Netherlands is the difference between the yields of 10-year and 2-year bonds, as data on the yields of 1-year bonds was not available

Source: Thomson Reuters Datastream

An important argument against such an intervention is related to liquidity, as the market segment is an important benchmark for a number of operations. The question is whether a further intervention on the long-end of the yield curve would be beneficial or harmful.

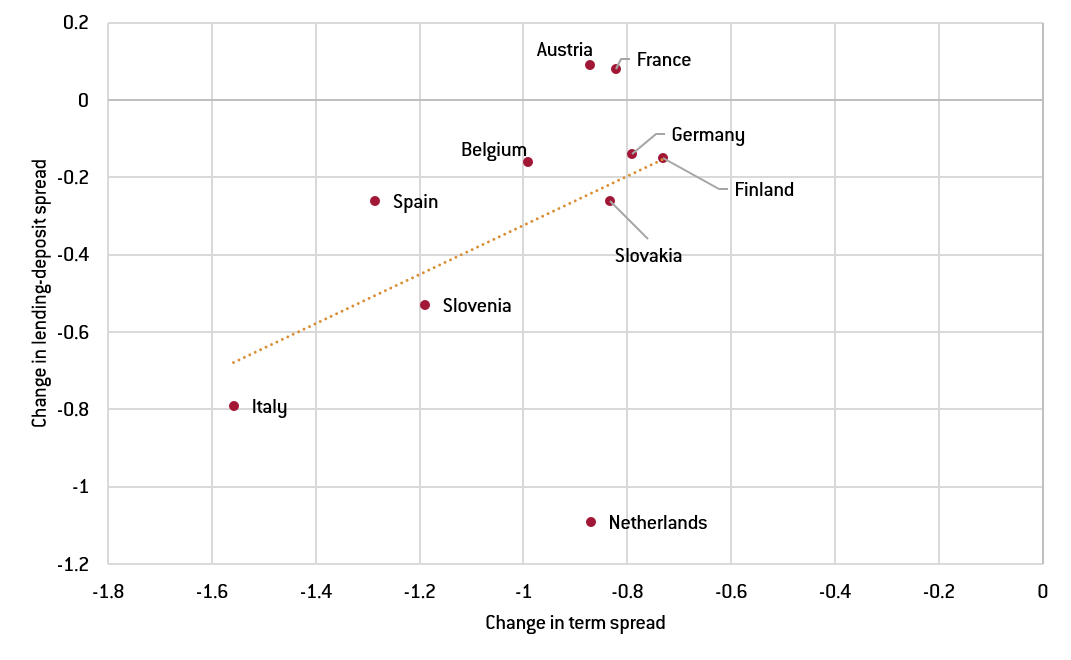

Chart 3. The changes in the term spread and the lending-deposit spread since January 2014

Source: Thomson Reuters Datastream and European Central Bank

Another consideration is the potential negative effects on banks. To gauge potential negative effects on financial institutions and banks in particular, we plot in Chart 3 a scatter diagram between the change in the term spread and the spread between the lending and the deposit rates of banks since the beginning of 2014. In the chart we see that the two variables are positively correlated. We report the change in the spread between lending and deposit rates also over time in Chart 4.

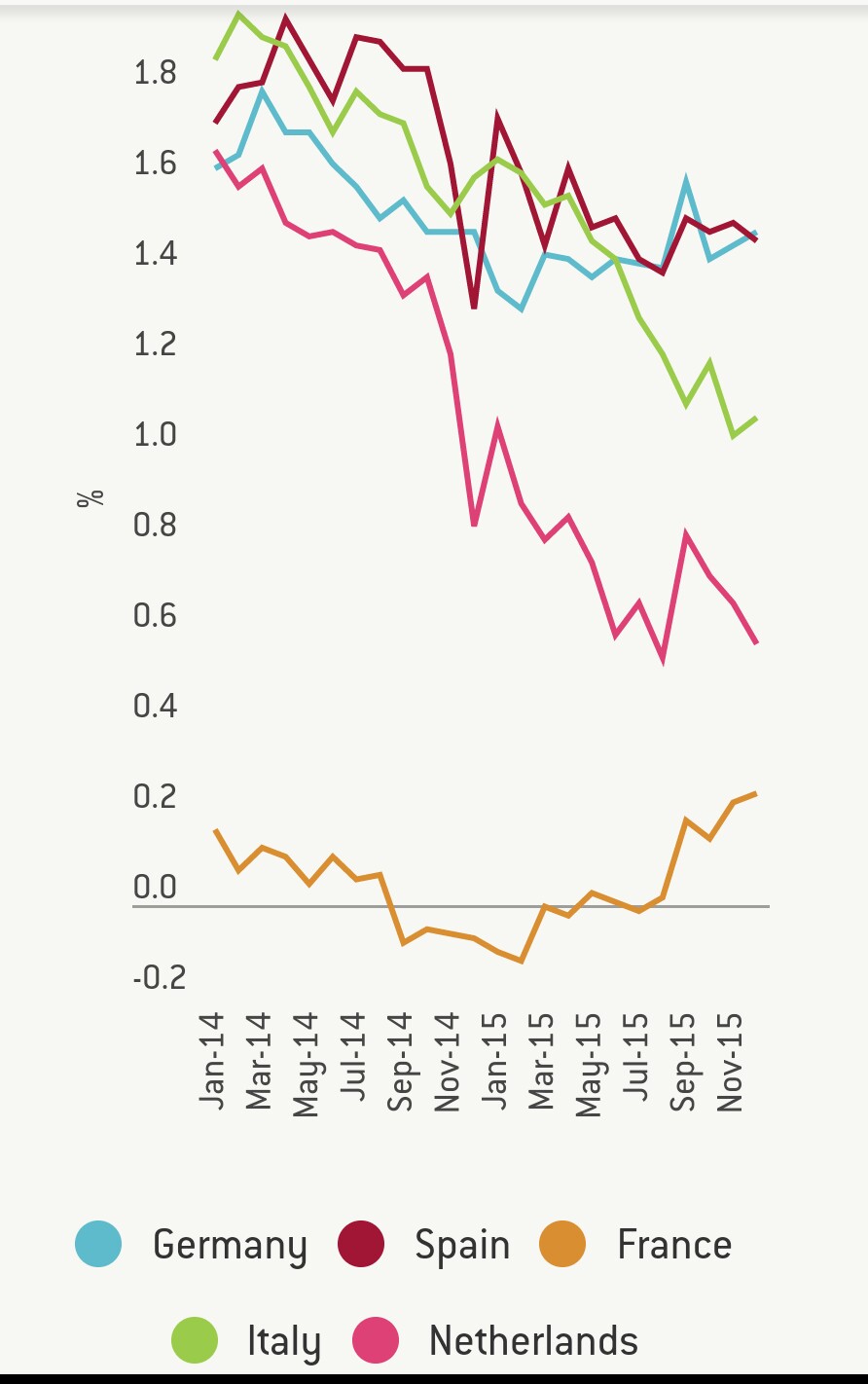

A fall in the term premium affects banks’ profitability to the extent that banks transform short-term deposits into long-term loans. Indeed, the data in Chart 4 show that the lending margins have fallen significantly in all reported countries except France.

This fall has favourable macroeconomic implications, analogous to an interest rate cut, as it makes bank lending cheaper for households and firms.

In addition, a correction in bank margins, which were pushed too high by the crisis, was probably inevitable. Still, banks need reasonable profits to carry out their needed intermediation function.

The risks to the banking system due to the low and compressed yield environment have even led the ECB’s chief banking supervisor, Danièle Nouy, to call for a change in the business model of banks, advising that banks move from an interest rate towards a fee-based approach.

Overall, the effectiveness of increasing government bond purchases is limited: the yield curve has flattened considerably, the recent lengthening of the period over which the ECB will conduct purchases had hardly any effect on inflation expectations, and continuing pressure on banks’ profits could jeopardize their intermediation capacity.

Chart 4. Spread between bank lending and deposit rates in from 2014 to 2016 (%)

Source: European Central Bank

An alternative option would be to move towards purchases of other asset classes. Experience in both the US and the euro area shows that QE works through the asset side and portfolio rebalancing. The important thing is not how many bank reserves (or how much base money) are created, but which assets are bought. The portfolio balance effect works by substituting one type of assets (long term bonds in the US and bonds as well as, in small amounts, asset-backed securities in the euro area) with an asset having very different characteristics, such as bank reserves.

So, if the ECB wished to give a new edge to QE it would be well advised to impart a new twist to its purchases, and venture into new assets (for a shopping list, see article).

The ECB could purchase a number of new assets. Adding corporate bonds to the purchases would be relatively easy. The market is relatively small in the euro area, but the “novelty factor” would be limited.

There would likely be a bigger novelty factor if the ECB bought senior bank bonds, and even more if it bought junior bank bonds. But it would be a bad idea for the ECB to further load itself with banking risk, not to mention the conflict of interest that would derive from its double role as bank supervisor.

In addition, it is not clear that continuing to insist on the banking channel to transmit the monetary policy impulse is the most efficient approach.

Purchasing equities, in the form of a broad market index, would undoubtedly have a strong novelty effect. This would be a bold move for a central bank like the ECB, even if there are the precedents of the Bank of Japan and the Hong Kong Monetary Authority. Another factor that would have to be taken into account is that equity risk would be added to the balance sheet of the Eurosystem.

Asset-backed securities (ABS) with non-performing loans as underlying assets could also be added to the purchase programme. However in this case it is not clear if this is a new type of asset, or just another asset in the existing ABS category.

According to the ECB’s general documentation, it seems that the Eurosystem could already buy these assets if they respected general requisites, including sufficient rating. While this kind of purchases would have a strong effect in the periphery, and especially in Italy, in aggregate terms its effect would be limited.

Finally, in theory, the ECB could purchase foreign assets, for example US Treasuries. But this would be contrary to G7 and G20 commitments and would be seen as the declaration of a currency war.

This means that there is limited scope for adding assets to ECB purchases. Adding some equity and corporate bonds could, however, be done.

Further lowering interest rates

Markets expect the ECB to further lower interest rates, as shown by the fact that overnight indexed swap (OIS) rates for maturities longer than 2 months are already lower than the current deposit rate at -30 basis points. What is less clear are the modalities and the amount of the cut.

As regards the modalities, it is likely that the ECB will have recourse to a tiering system for negative rates, like the Bank of Japan, the Swiss National Bank and Danmarks National Bank.

Applying different rates to different tranches of reserves deposited with the central bank, known as ‘tiering’, would reduce the average burden on banks while maintaining the stimulus coming from the lower marginal rate.

It should be recalled here that, in a way, the ECB already applies tiering to the reserves held with it: compulsory reserves, in fact, are remunerated at the rate of the Main Refinancing Operations, now at 5 basis points, and not at the negative deposit rate.

Indeed the ECB could reduce the average burden of negative interest rates on banks just by increasing required reserves, without modifying the structure of its operational framework. Tiering could also help to avoid excessively penalizing banks in the core of the euro area that hold a disproportionate amount of reserves at the central bank.

Tiering, however, would not help much in reducing the incentive for banks to arbitrage between bank reserves, with a negative return, and currency, with an intrinsic return of zero. This means that tiering would not substantially increase the latitude of central banks to push their rates deeper into the negative domain.

In fact banks will not react to the average cost of the negative interest rates on bank reserves, but to the marginal cost, the most penalising rate. Why would a bank hold the part of its reserves yielding deeply negative rates instead of exchanging it with currency, independently of the average cost of its reserves?

In addition, the effect on bank profits is not the only possible negative consequence of negative interest rates. Interest rates below 0 have hardly occurred for the past 5,000 years, (5) and so we do not know what their effects could be, so central banks will be cautious in progressing into the negative domain.

In assessing the effect of even more negative money market rates it should be recalled that short-term rates are, directly, mostly irrelevant for consumption and investment and thus for demand, economic activity and eventually inflation.

Changes in short-term interest rates by central banks matter as long as they lead to changes along the yield curve/risk curve of interest rates that are more important for households and firms. But with the yield curve as compressed as it is, there is little room left for this kind of indirect effects.

In conclusion, the statement by the ECB’s Governing Council that it has “a broad range of instruments and tools at its disposal” appears to us overly optimistic. Of course, such a bullish statement could be based on insider knowledge that some new, brilliant idea is being devised at the ECB. We will know on March 10th if this is indeed the case.

However, short of a coup de théâtre on the 10th, our view is that the ECB still has a few instruments readily available and that it should use them as effectively as possible in the pursuit of its price stability objective. But it should also be recognized that their effectiveness is likely to be quite limited and associated with significant side effects.

Beyond monetary policy, three major economic policy tools remain. The first one is so-called helicopter money. Helicopter money is in fact a fiscal policy tool, as it is a transfer from an inflation tax to the citizens receiving the “drop”.

Arguably, this tool is outside the mandate of most central banks in the world, and it would certainly evoke major controversy in the case of the ECB, which is not equipped with a centralised fiscal counterpart.

The second tool is outright fiscal policy. Yet, the countries eager to act, like Italy, Portugal, Spain and France, are the ones that should stay on the prudent side of fiscal policies.

Instead, the countries that have room to move, like Germany and the Netherlands, prejudicially refuse to recognise the problem of deficient demand in the euro area and will not even discuss fiscal easing.

In addition, there is little evidence that countries are following the ECB’s advice to change the composition and size of public revenue and expenses without changing the fiscal balances to make the budget more growth friendly.

A third tool is structural policy. The Chinese G20 presidency has emphasized the need to forcefully address structural weaknesses in all economies.

In China, overcapacities and the low consumption share point to the need for major structural reform. The euro area, in turn, has moved slowly on meaningful reforms. Even countries under severe financial stress have often only half-heartedly endorsed reforms, while major countries in the core of the euro area have barely reformed in the last 5 years.

Joint initiatives such as single energy and digital markets are progressing slowly, and uncertainty over the EU’s climate policy remains high. What is missing is a strong program of measures with a relatively quick impact on growth, such as major reforms in the energy market and single digital market or the implementation of a single market for services.

Indeed, within the nearly infinite number of conceivable structural measures, IMF analysis has identified those that have a growth pay-out in terms of quarters rather than years (6) and a programme coordinated at the euro-area level could bring significant growth and, eventually, price stability gains in the longer term.

Finally, deeper structural reforms would fundamentally alter the resilience and growth performance of our economies. Policymakers must diversify the financial system towards a greater role of capital markets, and address rising inequality. Progress in these areas is, in the best case, uncertain so far.

This post was co-authored with Guntram Wolff and published on the Bruegel website.

(1) A new arrow in the quiver of the ECB and the BoJ. https://moneymatters-monetarypolicy.eu/a-new-arrow-in-the-quiver-of-the-ecb-and-the-boj/

(2) We do not believe the ECB is ready to adopt the suggestion of Jablecki and Papadia, quoted above, to intervene in the market for inflation derivatives (https://moneymatters-monetarypolicy.eu/a-new-arrow-in-t…-ecb-and-the-boj/).

(3) An overall analysis of the ECB QE, consistent with the view that changes are needed to give it new effectiveness, is given in Gregory Claeys and Alvaro Leandro: The European Central Bank’s quantitative easing programme: limits and risks.

(4) Goodhart, C.A. and Ashworth, J.P., 2012. QE: a successful start may be running into diminishing returns. Oxford Review of Economic Policy, 28(4), pp.640-670. Meaning, J. and Zhu, F., 2011. The impact of recent central bank asset purchase programmes. BIS Quarterly Review, December.

(5) As shown in „Should we worry that we have about the lowest interest rates in the history of humanity?” https://moneymatters-monetarypolicy.eu/should-we-worry-that-we-have-about-the-lowest-interest-rates-in-the-history-of-humanity

(6) Alessio Terzihttp://bruegel.org/2015/07/reform-momentum-and-its-impact-on-

Frankly speaking, I don’t understand anymore this policy but what I understand is the perspective of muddling through. Not very exciting!