A few disparate thoughts on economics and politics.

I was recently asked to put together some thoughts for an interview. These are the notes that I used for that purpose.

One additional difficulty in getting a sense of where markets and, following them, economies could go is that, since quite a while, it is politics rather than economics that dominates developments and, as the unexpected Brexit and Trump results show, forecasting politics is even more difficult than forecasting economics.

Economic developments are quite favourable, more or less everywhere. At global level activity is acceptable. In the US, inflation has moved towards the Fed objective and unemployment is around, or even a little below, its NAIRU level. In the €-area the recovery is not exciting but quite consistent and there is a hope that inflation may, at last, approach the ECB target: the ECB projection that inflation will get back close to 2% (1.7), in 2019, may, after repeated failures, be correct. With around 1.8% growth, economic slack may be gradually reabsorbing, even if recently the ECB raised some questions about its measurement, in particular when it comes to unemployment: a broader definition of unemployment may be between 15 and 18 per cent, instead of the usual measurement of 9%. One question mark about the favourable inflation picture emerges from German wage behaviour, acting as a cap for wage and therefore inflation developments all across the €-area. This is slowing down the progress toward regaining price stability, but not impeding it eventually: even if weakened, the Phillips curve should eventually bring about somewhat higher wages in Germany.

Politics is, instead, mixed, even if the most recent developments are clearly favourable, more in EU than in the US, though.

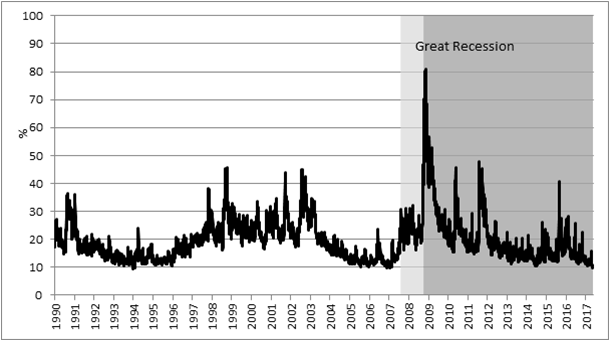

In the US I frankly do not understand the relaxed market attitude revealed, for instance, by VIX: the uncertainties coming out from the White House would require, in my view, a much more cautious attitude while VIX is at its lowest since before the beginning of the Great Recession (fig. 1). Developments over the last few hours seem to indicate that indeed a re-assessment is needed.

Figure 1. Volatility of asset prices in the United States (1990 – 2017).

Source: Chicago Board Options Exchange, CBOE Volatility Index. Note: VIX measures market expectation of near term volatility conveyed by stock index option prices.

In Europe, we had three favourable political events, after much angst: presidential elections in Austria, legislative elections in the Netherlands and, most importantly, presidential elections in France. In a deterministic setting, two points are sufficient to draw a line. In a stochastic setting, 3 points are too few to draw a line with a sufficient degree of confidence; still you cannot discard the meaning of these three events. In a way they confirm, at national level, a fourth, consistent event, namely the results of the last elections for the European Parliament a few years ago: populist are a growing threat but by no means a majority.

The results of the French presidential election open up the chance of more intense collaboration between France and Germany. This could take two configurations:

1. Great Bargain – France would offer to extend to Germany the protection of its Force de Frappe and/or its seat at the United Nations Security Council against a bold completion of Banking and Fiscal Union;

2. Small Bargain – France would implement the needed structural reforms, Germany would offer some more flexibility on public finance and a macro-economically relevant investment fund.

The first configuration, which would be a repeat of the Mitterrand – Kohl agreement that led to European monetary union, is unlikely, but of course would have a great impact if implemented. The second configuration is much more likely, but its effects would be blander. A big event with a small probability and a small event with a high probability likely lead to a similar expected benefit, which should be taken into account by markets and economic expectations in general.

Of course, the political situation in Italy is the next focal point of worry. On one hand it is difficult to figure out a positive scenario, like the one that seems to be developing in France with the Macron decisive victory in the presidential elections. On the other hand, I would tend to exclude dramatic events, like Italexit. The most likely development, in my view, is that elections, whenever they are held, will not deliver a clear majority likely to carry out the changes that are needed for the country to move away from its poor macroeconomic performance, now lasting nearly two decades. This, together with the lingering difficulties of the Italian banking system, could give rise to renewed tensions on government securities. At that moment two options open up: either another “Monti” technocratic government, carrying out the necessary emergency measures, or the entry of Italy into a troika program. This latter development would carry huge political costs, but economically it should be recognised that most troika countries, in particular Spain, Cyprus, Ireland, Portugal, have benefitted economically from being subject to the programs and are doing distinctly better than Italy. As far as the political costs are concerned, Italian policy makers should not complain if their ineffective action leads to the political cost of the troika. A reinforced French-German collaboration would be better able to deal with a possible Italian crisis. Of course, as Italian, I regret that my country is so often part of the problem rather than part of the solution.

Of course the medium term inconsistency between anaemic growth and high public debt remains in Italy. But this is exactly that: a medium term issue that needs not have immediate repercussions, as the hope remains that it will be dealt with, eventually.

Austria has recently added itself to the list of possible sources of shocks and one can just hope that it will not be an outlier to the four observations mentioned above about populists not being a majority.

As for the ECB, I see no fireworks coming from it in the short run. Indeed I see that it will continue with its policies without innovating on them, carrying on its QE program until the end of the year and not moving away from its negative interest rates. However, if things develop as they are currently expected to develop, I see the ECB announcing a tapering of its purchases in September, completing it in the first half of 2018 and moving away from negative rates in the second half of that year. Of course, this could make life a bit more complicated for Italy, as there would be less support for its securities, at a time when these may be under pressure because of domestic political events. If anything, this makes the probability that Italy enters into a program somewhat higher.

The reason why the ECB could announce a change of policy towards the end of this year, to be carried out next year, is that the improvements in the economic situations will give arguments to the hawks, who will no longer accept the truce that has prevailed until now in the ECB Governing Council, whereby they accepted QE and negative rates as a necessary evil, given the distance from the 2% inflation target.

As regards Brexit, I think that developments will confirm that this is definitely economically bad for both the UK and the rest of the EU. However, looking at economic parameters, like relative economic size or trade flows, the damage is likely to be a few times larger for the UK than for the rest of the EU. The hope is that overall damage would be limited, by both designing an extended transition and by keeping, after the transition, economic relations as close as possible in the new circumstances between the UK and the EU. Both sides have a strong economic interest to reach a good agreement in this respect. Political aspects, with their unpredictability, could derail, however, the reaching of a favourable agreement. This would confirm that political developments trump (yes, this verb is deliberately used) economic ones.