Emerging Market turmoil and the canary in the coal mine

There was a time when developments in Emerging Markets (EM) mattered a lot for them, but much less for the rest of the world, as they were too small and too isolated to really influence the global economy. These days are long gone: Chart 1 shows that in the eighties the share of EM in the global economy was still only a half of that of Developed Markets (DM), now the EM are slightly bigger than the DM economies in aggregate terms and the trend is forecast to continue.

Chart 1: Split of global GDP between EM and DM

|

| Source: IMF WEO, Authors’ calculations |

As a consequence, the turmoil that is affecting EM can have large global implications. Indeed some observers fear that the Great Recession could now have a third EM phase, after having had an American and then a European phase. Whether this risk will materialise depends on the intensity and duration of the EM turmoil as well as on the effect this will have on the DM part of the world.

I read a number of analyses assessing that it is too early to proclaim another phase of the crisis, rather advancing the idea that, as EM provided a stabilising effect for the global economy when DM were at the epicentre of the crisis, so now the opposite could take place, with DM providing a partially stabilising effect to the global economy. Indeed chart 2 shows that emerging economies had a less deep through during the Great Recession than DM and thus attenuated the fall of activity at world level. A portfolio effect would thus be at work in the global economy: when one region does particularly bad (or well) there will be another region that will partially compensate its negative (positive) effect on the world economy.

Chart 2: Contribution to annual growth of world GDP of EM and DM

|

| Source: IMF WEO |

This post, however, has nothing original to contribute to this issue. Its purpose is, instead, to detect incipient signs of the EM turmoil affecting DM: is there a canary that could signal negative winds blowing from EM to DM?

The immediate idea is to look for this canary in peripheral Europe and in financial variables: in peripheral Europe as the most vulnerable region, just now painfully emerging from its own crisis; in financial variables as the ones that react more quickly.

So the question is: has the turmoil in EM particularly affected financial variables in peripheral European countries? More precisely, if we rank peripheral countries by the intensity of their vulnerability (say measured by their sovereign bond spreads to German securities before the turmoil), is there evidence that the most vulnerable, peripheral countries were affected more by the turmoil? Of course, this type of analysis overlooks other factors that could make one or the other country particularly sensitive to the EM turmoil, for instance particular trade or financial links (say between Spain and Latin America) or specific competition patterns (say the competition in tourism between Greece and Turkey). Still, we could extract from this approach some information on the possible influence from EM to DM and try to locate the “canary”.

Table 1: Rank correlations of pre and post EM turmoil

|

Change since beginning of turmoil (23-Jan-2014) in:

|

||||

|

10 year bond spreads

on 23-Jan-2014 in %

|

Bond spreads

in %

|

5 yr USD CDS

|

Stock exchange in %

|

|

|

GR

|

6.420

|

0.136

|

-18.375

|

-2.18

|

|

PT

|

3.423

|

-0.040

|

10.000

|

-1.93

|

|

SI

|

2.926

|

0.168

|

16.000

|

-3.70

|

|

IT

|

2.150

|

-0.017

|

16.165

|

-4.01

|

|

ES

|

2.040

|

0.060

|

8.750

|

-4.75

|

|

IE

|

1.582

|

0.089

|

5.335

|

-3.08

|

|

SK

|

0.783

|

0.042

|

3.665

|

-2.86

|

|

FR

|

0.714

|

-0.133

|

3.335

|

-3.82

|

|

BE

|

0.623

|

0.094

|

2.005

|

-3.53

|

|

AT

|

0.363

|

-0.101

|

8.015

|

-5.97

|

|

NL

|

0.328

|

-0.103

|

2.845

|

-5.18

|

|

FI

|

0.224

|

-0.105

|

0.420

|

-4.31

|

|

Rank correlation coefficient between spreads on 23-Jan-2014 and variables on right columns

|

0.6154

|

0.4266

|

-0.6434

|

|

|

Memo Items

|

10 year bond yield change

|

5 yr USD CDS

|

Stock exchange % change

|

|

|

US

|

-0.157

|

-1.460

|

-4.01

|

|

|

Japan

|

-0.077

|

2.050

|

-10.75

|

|

|

DE

|

-0.050

|

1.840

|

-5.22

|

|

|

Eurostoxx

|

-4.96

|

|||

|

EUR effective rate (Q1 1990= 100)

|

-0.68

|

|||

Source: Bloomberg, Authors’ calculations

Table 1 above tests this hypothesis and indeed shows that the most vulnerable, peripheral, countries suffered more than core countries as far as sovereign spreads are concerned: as shown by the rank correlation coefficient, peripheral countries that had a higher spread before the EM turmoil recorded during the turmoil a larger increase in this spread than core countries, many of which indeed reduced their spread. A similar result applies to the changes in the CDS. This is evidence of a flight to quality towards the stronger countries in the €-area, which also occurred at global level as yields on American, Japanese and German sovereign bonds went down during the turmoil, while there were substantial losses on the stock exchanges of the US, Germany, the entire EU and, particularly, Japan. So, sovereign spreads in peripheral Europe seem well placed to play the canary role even if, overall, their increase was limited, reinforcing the view that the crisis in the €-area is on its way out.

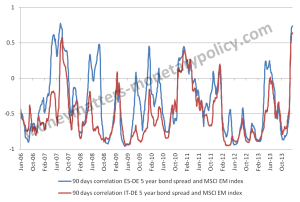

To further test the idea that spreads in the periphery of the €-area are particularly sensitive to the EM turmoil it is useful to look, in Chart 3, at the correlation between the sovereign spread of the two largest peripheral countries and the spread on EM bonds denominated in dollars. This correlation has been mostly negative but very unstable, thus not indicating a constant relationship between the spread in the EM and that in Italy and Spain. However, the correlation spikes in the most recent period at the highest level since 2006, showing that the spreads of Italy and Spain tend now to move together with those of emerging markets, providing a further indication that there is a stress correlation between the periphery of the €-area and EM.

Source: Bloomberg, Authors’ calculations

What is somewhat puzzling in table 1 is that, as indicated by the negative rank correlation coefficient, in peripheral countries, which were more stressed before the turmoil and where the sovereign spread increased during the turmoil, the losses on the stock exchange were smaller. One possible interpretation is that investors in peripheral jurisdictions are particularly focussed on sovereign spreads, taken to be the really critical variable, rather than on stock exchanges and thus the risk-off wave affects spreads more than stocks.

What is somewhat puzzling in table 1 is that, as indicated by the negative rank correlation coefficient, in peripheral countries, which were more stressed before the turmoil and where the sovereign spread increased during the turmoil, the losses on the stock exchange were smaller. One possible interpretation is that investors in peripheral jurisdictions are particularly focussed on sovereign spreads, taken to be the really critical variable, rather than on stock exchanges and thus the risk-off wave affects spreads more than stocks.

In conclusion we have two candidates for the role of canary in the coal mine: the spread on sovereign bonds in the periphery of the €-area and the stocks of core €-area countries and the largest DM. Particular attention to these two variables can give a timely information of how much EM is nowadays affecting DM.

*** Research assistance was provided by Mădălina Norocea