The € and Italian growth.

Introduction.

This post tries to answer the question whether the € has a responsibility in the poor growth performance of Italy, as some Italian politicians claimed.

While in economics there are no 100 per cent certainties, the evidence accumulated in this post is that it is unlikely that the € has a responsibility in the dismal growth performance of Italy over the last two decades or so. Since there are other, more plausible, possible causes of Italian stagnation, looking at the € is not just misguided but utterly damaging, as it distracts from taking the measures needed to put Italy on a higher growth path. The specification of these measures is left for another time.

The conclusion that Italian stagnation is not caused by the € is reached on the basis of the following nine points:

- Italy has hardly grown over the last two decades,

- But the responsibility of the € in this poor performance is hard to reconcile with the dearth of economic models in which monetary factors determine long-term stagnation,

- Furthermore, the time pattern of Italian growth slowdown does not fit well with a responsibility for the €,

- The reduction of unemployment, in Italy but also in other €-area countries, in the first years of the single currency also does not fit well with a responsibility of the €,

- And the experience of Italy is quite worse than that of the other €-area countries, in particular Spain, which belongs like Italy to the €-periphery, thus shedding further doubts on the € as cause of the stagnation,

- The introduction of the € has led to lower real interest rates, which likely had, in Italy and Spain, a negative effect on productivity growth in the first years of the single currency,

- But it is not clear that this negative effect on productivity can be extended to real growth,

- The record of Italy in managing its exchange rate has been historically pretty poor and the loss of the ability to devalue the currency is more a benefit than a cost,

- There is a host of structural reasons that can explain the long-term poor growth performance of Italy, without the need to look for a responsibility for the €.

- Italy has hardly grown over the last two decades.

The average annual rate of growth per head of Italy since the adoption of the € (1999-2016) has been zero (table 1). For comparison purposes, that of Spain has been 1.08, that of France 0.84 and that of Germany 1.25 per cent. The relative underperformance of Italy with respect to the other three countries is thus an obvious fact. Just to make it simple: the other three countries that adopted the € at the same time as Italy grew, on average, by about 1 per cent every year since the introduction of the €, while the Italian economy has stagnated. This is a first symptom that there is something special about the dismal growth performance of Italy, and its reasons seem to go beyond the adoption of the €.

Table 1. Average annual real growth per head in Italy, Spain, Germany and France. (1999-2016).

| France | Germany | Italy | Spain |

| 0.84% | 1.25% | 0.00% | 1.08% |

Source: International Monetary Fund World Economic Outlook.

- The adoption of the € is sometimes blamed, more by politicians than by economists, as the cause of this lack of growth.

For instance, the then Italian interior Minister, Maroni, on June 3rd 2005, declared in an interview to La Repubblica 1 : “It’s time to get back to the lira: let’s ask a vote from the Italians, And so, should we return to the lira? I say this hypothesis should not be discarded, since it is surely not odd. Since three years the euro has shown, not because of its own fault but because of the responsibilities of those who managed the transition to the single currency, it cannot adequately deal with the slowing growth, the loss of competitiveness and the employment crisis. Is it not better to get back, at least temporarily, to a system of double monetary circulation?“

Former Italian Prime Minister Berlusconi called, in November 2014, for a second national currency, which would allow regaining monetary sovereignty. In October 2015, he returned to the subject, stating that: 2 “I remember, after the second world war, there was a second currency in circulation, parallel to the lira, from 1943 to 1953. I don’t say let’s get out of the euro, but there is no legal directive in the European acquis that would prevent from introducing a national currency. We already have a name for it, it’s called lira, and the exchange rate against the euro would be given by the market. Why not give it a try?”

In contrast, Alesina and Giavazzi published a piece on Corriere della Sera 3 , stating that there is indeed: “…the need for a European debate on how to (even radically) reorganize the functioning of the monetary union. But the critical issue of the current electoral campaign is whether we want Italy to leave immediately and unilaterally monetary union, and the European Union eventually, becoming a pariah in Europe”

Even if the two issues should be clearly distinguished, the issue about the responsibility of the € in the Italian slow-down is often conflated with the assertion that it is austerity that caused stagnation in Italy. “It’s currently very trendy in Italy to blame Angela Merkel, Mario Monti, and austerity measures for the current recession.” 4 In this post only the possible responsibility of the € is considered. The question about austerity is left for another time. Here just let me note that the arch-champion of austerity, Germany, has been, since quite a few years, the best performing economy in the euro area, with a very low unemployment rate.

3 The responsibility of the € is hard to reconcile with the dearth of models in which monetary factors determine long-term stagnation.

One of the first principles economic students are taught is about the neutrality of money. Basically this principle states that if the stock of money is doubled, in the long term the only effect is a doubling of the price level, without any change in real variables

Two qualifications have been developed over the decades to this basic result. The first qualification is that “super-neutrality”, a beefed-up version of the neutrality of money, does not hold. The second qualification goes under the name of “hysteresis”, also coming in a powered-up version of super-hysteresis.

Money super-neutrality posits that changes in the rates of growth of money, as opposed to changes in its stock, would leave all real variables unchanged. This debate dates back some 30 years ago 5 . Although money is super-neutral in the Sidrauski (1967) growth model, various extensions of the model provide cases in which super-neutrality does not hold. However, as McCallum (1990) notes, deviations from super-neutrality should be minor and, in addition, do not seem to particularly affect the growth rate.

In 1986 Blanchard and Summers 6 came up with the hysteresis hypothesis, which can explain persistently negative effects from recessions on the level of real GDP, including those caused by monetary tightening. More recently, Blanchard, Cerutti and Summers (2015) 7 have explored empirically this hypothesis and its powered-up version of super-hysteresis, whereby a recession could have persistent effects not just on the level of income but also on its rate of growth. One possible cause of hysteresis is that a recession, including one caused by monetary policy, can have a persistent effect on the natural rate of unemployment because unemployed workers can lose competences and abilities, and this reduces their fitness for productive work. This will in turn shift the Phillips curve up and to the right, thus worsening the short-term unemployment-inflation trade-off. The authors find “that a high proportion of recessions, about two-thirds, are followed by lower output relative to the pre-recession trend even after the economy has recovered. Perhaps more surprisingly, in about one-half of those cases, the recession is followed not just by lower output, but by lower output growth relative to the pre-recession output trend.”

The authors do not explicitly address the symmetric case, in which a macroeconomic expansion can have persistent and positive effects on the level or the rate of growth of income, but I see no special reason why this should not be the case.

There are two reasons why the presence of hysteresis, or super hysteresis for that matter, is irrelevant for the debate about the possible effect of the € on growth. The first reason is that it is hard to believe that the effect on growth, as opposed of that on the GDP level, can last two decades. The second, more radical, reason is, as the next section shows, that initially the introduction of the € did not coincide with a recession in Italy. If anything the introduction of the € provided a positive macroeconomic shock not a recession and hysteresis (or super-hysteresis) should have kept these favourable effects lingering for some time.

4 The timing of the Italian slowdown does not fit with the responsibility of the € in the Italian stagnation.

The first, obvious but not conclusive, check in looking for an effect of the € on growth is whether the introduction of the € in 1999 coincides with a break towards a lower rate of growth in Italy. Given that real growth and unemployment tell two similar but not identical stories, it is also useful to check whether the introduction of the € coincided with a shift to higher unemployment.

Figure 1. Real growth and unemployment in Italy (1960-2016).

Source:European Commission, Annual Macro – Economic database (AMECO). World Bank.

Figure 1, which presents the evidence relating to nearly 60 years, is divided in three zones:

- Pre-€,

- Stability Period, denoting the first years of the €,

- The Great Recession.

Several developments clearly emerge from the figure:

- A long-term trend of deteriorating growth, decade after decade, as shown by the trend line,

- High instability of growth between the 1960s and the middle of the 1980s, followed by a Great Moderation until the beginning of the crisis,

- The trough during the 2009 recession is the deepest since the 1960s, even if a similar deceleration of growth took place in the 1970s,

- Unemployment recorded a trend deterioration between around 1970 and 1998, a significant improvement in the “Stability Period”, which brought it to the lowest level since the beginning of the 1970s, and then again a worsening during the Great Recession.

What does not emerge clearly from this long time series is a worsening of the macroeconomic performance coinciding with the introduction of the €. Indeed in the lower part of the figure we don’t see more negative deviations from trend in the € period with respect to the pre-€ period. If anything we see more positive than negative deviations from trend in the “Stability Period”.

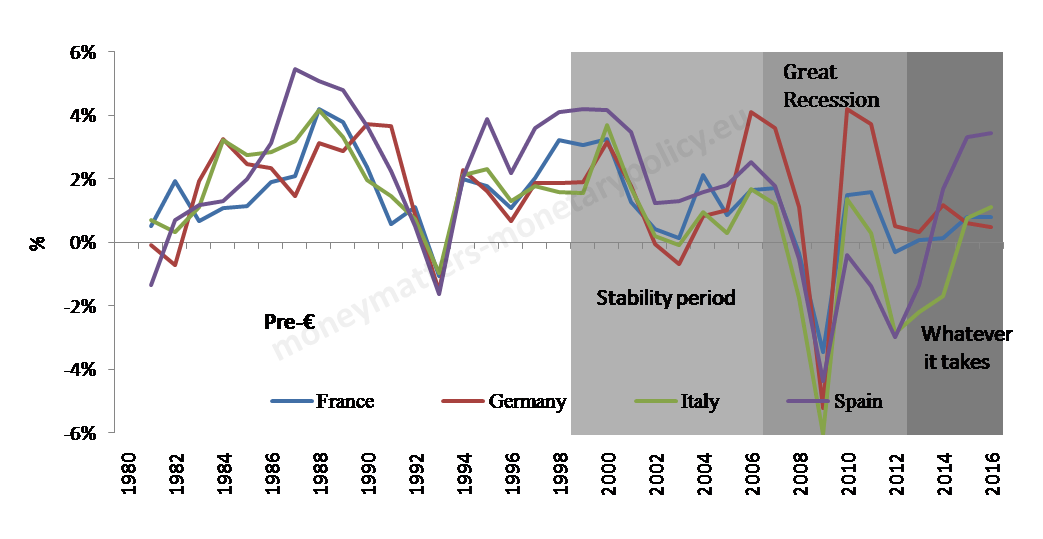

To further check for a negative impact of the € on Italian growth, it is useful to compare the Italian growth performance to that of the three other large €-area countries: Germany, France and Spain. This is done in figure 2.

Figure 2. Real growth per head in the periphery (Spain and Italy) and in the core (Germany and France) of the euro-area.

Source: World Bank.

Figure 2 is divided in the same zones as figure 1, but distinguishes a sub period since 2012, when ECB President Draghi made his famous speech about the ECB doing “Whatever it takes” to preserve the €, since growth recovered in this period, in particular in Spain. The figure shows that the long-term trend of slowing growth is not limited to Italy, but is common to all four countries. In addition, the adoption of the € does not coincide with a break in growth for the four countries, if anything it coincides with a higher growth in Italy and Germany in 2000 and the continuation of a very high growth rate in Spain. In the figure we then see a slowdown of the four countries in 2002-2004, a good recovery and then the dramatic plunge of the Great Recession. Germany and France recovered quite quickly from the Great Recession. Spain took a while longer but then grew fast in the “Whatever it takes” period. Italy lags behind all the three other countries both in time and in intensity.

Overall, we do not find a break in growth for Italy, or the other three countries for that matter, when the € was introduced. The poor growth performance of Italy needs some special explanation: none of the three other large countries adopting the €, not even Spain that belongs with Italy to the same group of peripheral countries, had such a bad performance since the € was introduced.

This is confirmed looking at table 2, which reports the average growth in the same periods as in figure 2, only splitting the pre-€ period in two sub-periods. The trend slowdown of growth, with a trough during the Great Recession is visible in all the countries considered, but is particularly acute in Italy. So, again, there seems to be something special about the slow growth of Italy. What is also interesting is that, unlike what happened in the three other large €-area countries, growth in Spain accelerated between the “Second Pre-€” and the “Stability Period”.

Table 2. Average annual per cent real growth per capita in Italy, Spain, Germany and France (1961-2016).

| Italy | Spain | France | Germany | |

| First Pre-€

1961-1980 |

4.16 | 4.46 | 3.73 | 2.89 |

| Second Pre-€ 1981-1998 |

1.92 | 2.25 | 1.67 | 1.86 |

| Stability Period 1999-2006 |

1.23 | 2.59 | 1.54 | 1.39 |

| ” 2007-2012 |

-1.33 | -1.31 | 0.11 | 1.57 |

| Whatever it takes 2012-2016 |

-0.95 | 0.77 | 0.32 | 0.64 |

| Entire period 1961-2016 |

2.11 | 2.67 | 2.14 | 1.87 |

Source: World Bank.

(*)data for Germany since 1971

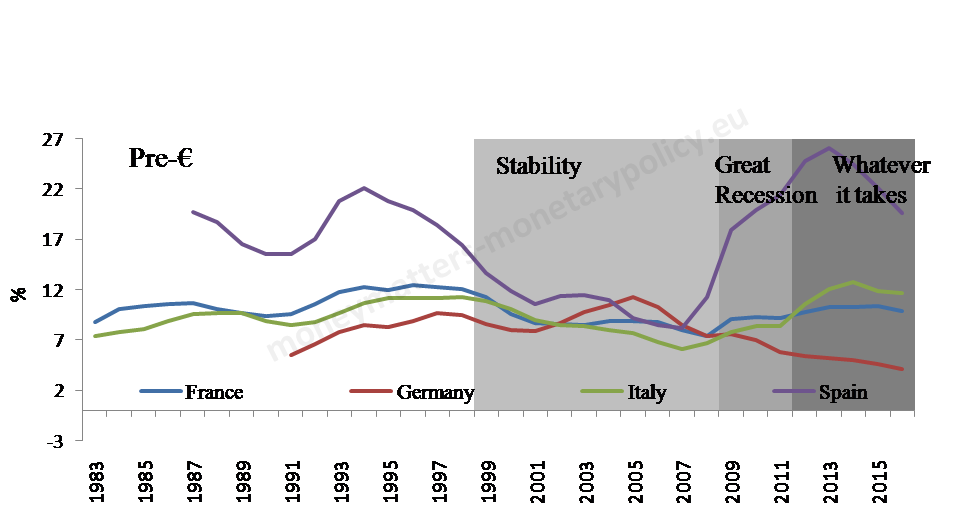

The evidence about unemployment in Figure 3 raises some other issues which are difficult to reconcile with the idea that the introduction of the € had, as such, a depressive effect on Italy, and on the other large countries in the €-area: as was already seen in Figure 1, unemployment in Italy nearly halved from more than 11 per cent in 1998 to slightly above 6 per cent in 2007. The behaviour of unemployment in Spain was even more impressive, as it more than halved in the same period from nearly 19 per cent in 1998 to slightly above 8 per cent in 2007, far lower than in any period since the beginning of the 1980s. The improvements in unemployment rates in Germany and France during the first decade of the € were much smaller, but still visible. The different results on growth and unemployment start telling us something about productivity. This is an issue covered in the next section.

Before getting to that, let’s observe that, of course, Italy’s and, even more, Spain’s unemployment performed much more poorly than that of Germany and France during the Great Recession. Only in the last 4 -5 years did performance start to improve in Italy and Spain, but only in the latter country in a decisive way.

Figure 3. Unemployment in the periphery (Spain and Italy) and in the core (Germany and France) of the euro-area (1983-2016).

Overall, the evidence on growth and unemployment does not lend itself to a clear link between the introduction of the € and the dismal performance of Italy since 1999. The facts that are not consistent with this link are the following:

- Over a long time series there is no apparent break of growth in Italy coinciding with the € introduction,

- In the first two years after the introduction of the €, growth increased rather than decrease in Italy,

- The growth performance of Italy was much worse than that of the other three large countries that also adopted the €, in particular that of Spain that belongs to the same group of peripheral countries,

- Unemployment in Italy and also in Spain and the other two countries, came down significantly in the first years after the introduction of the €, i.e. the “Stability Period” before the Great Recession struck.

5 More complex models are needed to further probe a possible link between growth and the €.

If we want to explore further a possible negative impact of the € on growth in Italy, and possibly in Spain, we should extend and complicate the analysis.

One intriguing avenue of analysis in this direction is proposed by Cette, Fernald and Mojon 8 . According to these authors, the lowering of real rates that took place alongside the introduction of the € would have brought about a reduction of Total Factor Productivity growth. A similar point was made by Giugliano and Odendahl 9 . Basically the idea is that the lower cost of capital led to worse capital allocation. While Cette and al. explore, and confirm empirically, the relationship between the real rate of interest and TFP growth, they do not extend their analysis to the subsequent possible link in the chain, i.e. from TFP to GDP real growth rates. Of course the strength of this link is, in principle, weakened by possibly changes in resource utilization, for instance, unemployment changes will affect GDP growth even with constant productivity.

To establish the responsibility of the € for the growth slowdown in Italy, we should find some systematic chain correlation, and even causation, between the €, real rates of interest, rates of TFP growth and real income growth. The first link in the causation chain is well established, including in a post of mine 10 and in the paper itself by Cette and al. The latter paper also establishes a link, through VAR methodology, between real rates and productivity. This effect would have been particularly visible in the case of Spain and Italy between the mid 1990 and the mid 2000s.

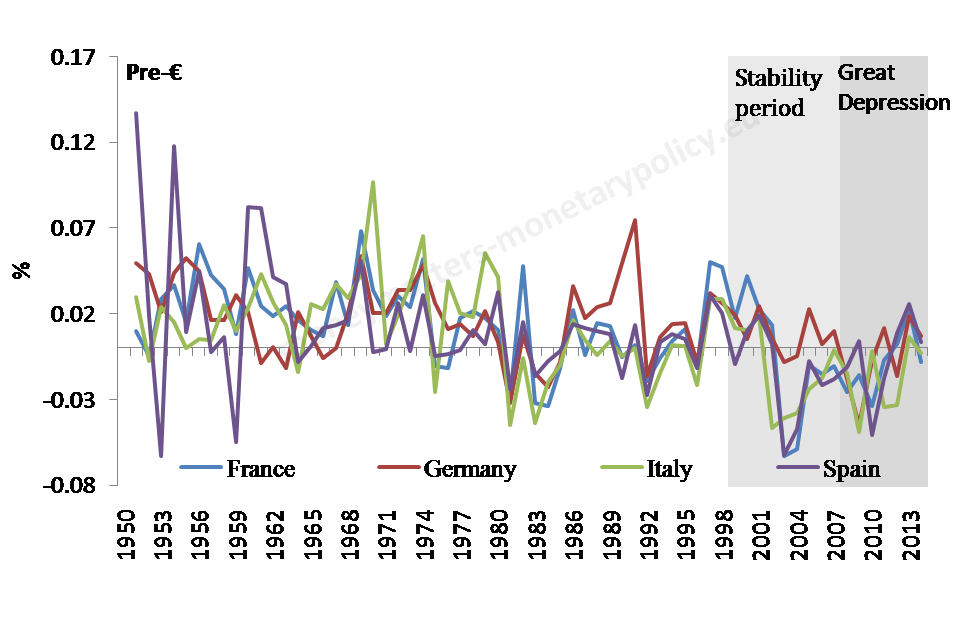

To check the existence of a systematic chain correlation, and possibly causation, between real interest rates, productivity changes and real growth, it is useful to start from Figure 4, reporting total factor productivity growth in Italy, Germany, France and Spain over roughly the last seven decades.

Figure 4. Total factor productivity (TFP) growth in the periphery (Spain and Italy) and in the core (Germany and France) of the euro-area (1990-2016).

Source: Penn World Tables.

Source: Penn World Tables.

In the figure we observe an irregular but clear downward trend for all the four countries, so that TFP growth ends up being mostly negative for France, Spain and Italy in the first decade of the 2000s. Looking carefully through the high volatility, one can also see, in conformity with the Cette and al. results, a temporary trough in TFP growth in Italy and Spain in the first half of the 2000s, in rough correspondence with the lower real rates brought about by the introduction of the €.

To further check on a possible chain link between the introduction of the €, on one end of the causality chain, and growth, on the other end, it is useful to look at table 3, giving averages of real interest rates, TFP changes, and real growth per head in Italy, Spain, Germany and France in: (a shorter) “Pre-€ period” and then in the “Stability” and the “Great Recession” periods, to see which kind of association there is between real interest rate, TFP changes and growth.

Table 3. Real interest rates, TFP growth and real growth per head. Averages in different periods.

| Pre-€

1985-1998 |

Stability Period 1999-2008 | Great Recession

2009-2015 |

|

| France | |||

| Real interest rate | 6.44 | 3.23 | 1.80 |

| TFP changes | 0.75 | -0.88 | -0.67 |

| Real growth per head | 1.69 | 1.40 | 0.13 |

| Germany | |||

| Real interest rate | 3.03 | 3.03 | 1.14 |

| TFP changes | 2.06 | 0.59 | -0.52 |

| Real growth per head | 1.75 | 1.67 | 0.72 |

| Italy | |||

| Real interest rate | 6.58 | 3.27 | 3.44 |

| TFP changes | -0.04 | -1.42 | -1.91 |

| Real growth per head | 1.88 | 0.94 | -1.16 |

| Spain | |||

| Real interest rate | 7.37 | 2.15 | 3.60 |

| TFP changes | 0.47 | -1.46 | -0.43 |

| Real growth per head | 2.38 | 2.15 | -0.26 |

Table 3 is far from representing a formal test of the correlation between the three variables of interest, still it shows some interesting information. Overall, we find that the decrease over time of TFP growth, that of the real interest rate and that of growth per head is a generalized phenomenon in the four countries. However there are also some interesting remarks in addition to this general, common move. For instance, all countries achieve significant growth during the “Stability Period” even if TFP growth becomes negative in all countries except Germany, as a confirmation that unemployment decreased in that period. It is also interesting that the real rate of interest went up in Italy and Spain in the “Great Recession” period, but growth went further down in the two countries and TFP growth decreased further in Italy. In the same period the real interest rate went down in France but the growth rate of TFP improved.

Overall, we may conclude, following Cette and al., that there probably was a negative effect on TFP growth in Italy and Spain from lower real rates of interest in the “Stability Period”, caused in turn by the introduction of the €. However, the chain link between the introduction of the €, low real rates of interest, lower rates of TFP growth and lower real growth is not strong enough to confirm the statement that the introduction of the €, and the consequent reduction of real interest rates, caused a slowdown in the periphery of the €-area, and particularly in Italy. This conclusion is not surprising taking into account than in the standard IS-LM model a decrease of the real interest rate has an expansionary effect. Indeed the sign of the effect of changes on real interest rate on aggregate supply (i.e. in the long-term) is arguably the opposite of that on aggregate demand (i.e. in the short-term): an increase in the real rate of interest has a positive long-term effect on aggregate supply, through its effect on productivity, but a negative short term effect on aggregate demand.

A different line of analysis to attribute the responsibility of Italian stagnation to the € is that it was not the introduction of the € per se that led to lower growth but the combined effect of the existence of the € and the financial crisis, which started in the US and was made more acute by the Greek statistical misreporting.

According to this line of analysis, monetary union may have not allowed a devaluation to offset the idiosyncratic shock affecting Italy, as well as Spain and other peripheral countries, when the Great Recession hit and forced these two countries to more costly internal devaluations. Of course it is true that the Maastricht design was incomplete and that no tool to mutualize idiosyncratic shock was foreseen to substitute for the loss of the freedom to change the exchange rate. During the crisis this lack was partially substituted by the EFSF and ESM loans and, more importantly, by the ECB action. Still there remains an unfinished business here. However, before proclaiming the salvific role that an exchange rate devaluation could have played, one has to look at the Italian experience with a chronically weak currency before the €. This is done in the following paragraph.

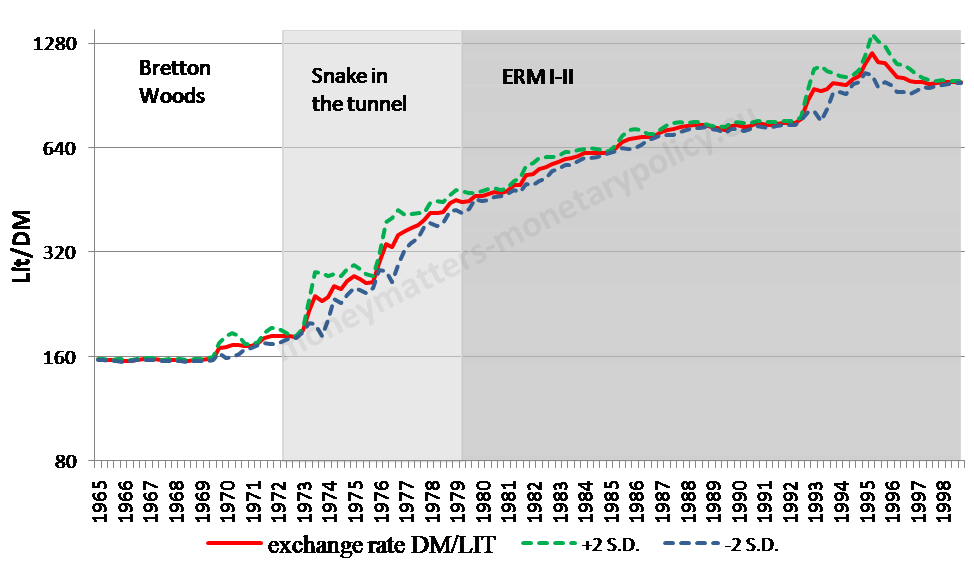

- The lira was not better for growth than the €.

Basically between the abandonment of the fixed exchange rate of the lira against the dollar in 1973 and the approximation to the € in the second half of the 1990s, monetary history in Italy was a sorrow experience of high and variable inflation and devaluation, without long term improvements in growth or the labour market.

Figure 5 is divided in three areas denoting the different exchange rate arrangements of the lira before the adoption of the €: the Bretton Woods system, the so called Snake, i.e. the first attempt of European countries to stabilize their reciprocal exchange rate, and finally the Exchange Rate Mechanism. The figure shows the relentless devaluation of the lira against the Deutsche Mark since the lira lost its link to the dollar, with the demise of Bretton Woods, and until the prospect that it would be substituted by the € towards the end of the 1990s: at the beginning of the 1970s one Deutsch mark bought 160 lira, towards the end of the 1990s it bought about one thousand. And the trend devaluation of the lira was accompanied, albeit with different intensity, by substantial variability all through the three decades, as shown by the green and the blue lines around the red line of the devaluing exchange rate.

Figure 5. Exchange rate between the Italian Lira and the Deutsche Mark (1965 – 1998).

Source: IMF-International Financial Statistics. Note: the exchange rate is bracketed by 2 standard deviations above and below it calculated over the previous three years.

The devaluation of the exchange rate was accompanied, until the prospect of monetary union started to have its effects in the second half of the 1990s, by much higher interest and inflation rates in Italy with respect to Germany. This evidence shows that the way to keep interest rates low on a sustainable basis is to have low inflation on a sustainable basis, which means raising rates when this is necessary to keep inflation in check. Just to make it specific, and painful for someone having spent many years at the Banca d’Italia: notwithstanding much undocumented commentary to the contrary, the Bundesbank was much better at keeping interest rates consistently low than the Banca d’Italia.

Of course the symmetric statement, which many in Germany find difficult to accept, also holds: in order to avoid excessively low inflation and interest rates on a permanent basis, sometimes, as now, interest rates have to be lowered to exceptionally low levels.

Figure 6. Interest rate spread and inflation differential between Italy and Germany (1965 – 1998).

Source: European Commission, Annual Macro – Economic database (AMECO).

So, let’s establish a fact and build a prognosis upon the fact: the fact is that between the abandonment of Bretton Woods and the adoption of the €, Italy was affected by a weak and volatile exchange rate, high and variable interest and inflation rates; the prognosis is that an abandonment of the € would lead to a repetition of that sorrow experience.

There is general agreement that high and variable inflation and interest rates as well as a continuously devaluing and volatile currency have negative welfare effects. In order to further probe this conclusion let’s look at the Italian experience with the balance of payments and the labour market in the period since the lira lost its link to the dollar and until it was substituted by the €.

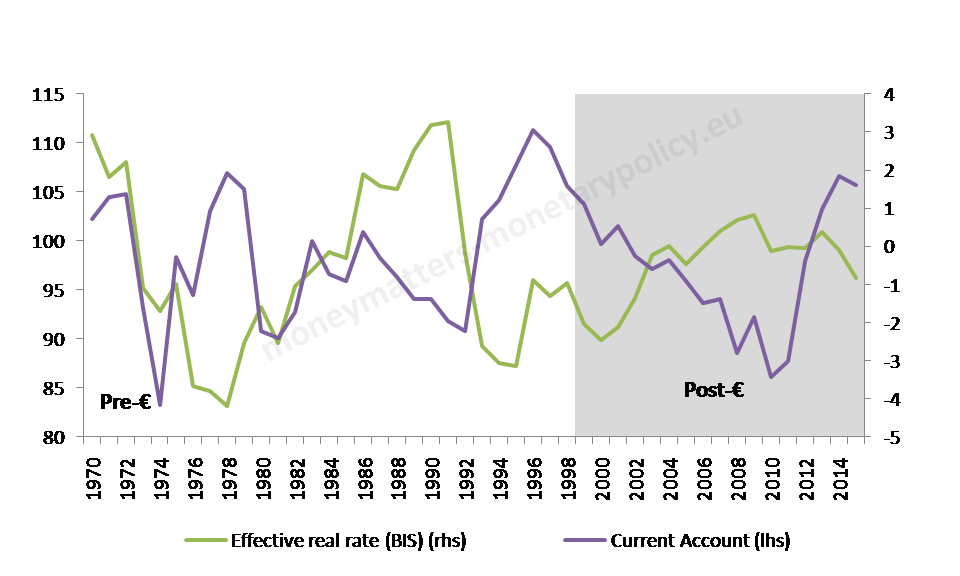

Figure 7. Real exchange rate and the current account as percent of GDP in Italy (1970 – 2016).

Source: Bank for International Settlements.

Source: Bank for International Settlements.

In the figure we detect, until the introduction of the €, episodes of gradual loss of competitiveness, due to the high inflation, leading to large current account deficits, followed by sharp depreciations, bringing back the current account into positive territory.

As regards the labour market, Demertzis and al. 11 examine the experience of Italy with the lira between 1980 and 1999 and conclude: “ In the decades before Italy joined the Euro, the Lira was devalued many times relative to the Deutschmark. Were these re-alignments accompanied by long term improvements on the labour market? The data suggests this was not the case.” Their conclusion is rather that improvements on the employment front were achieved when the exchange rate was stable rather than when it was devalued.

A check about a possible association between the exchange rate and growth and unemployment can be gathered from figure 8.

Figure 8. Real exchange rate, real growth and unemployment in Italy (1965-1999)

Source:European Commission, Annual Macro – Economic database (AMECO). World Bank , Bank for International Settlements.

Figure 8 shows that the period in which Italy was without an external constraint on its exchange rate, i.e. between the demise of the Bretton Woods System in 1973 and the adoption of the € at the end of the 1990s, the Italian economy suffered from a volatile exchange rate and two, internally consistent, negative trends: lower growth and higher unemployment. This experience suggests that Italy’s governance system has difficulties managing its currency and thus devaluations were the end result of faulty macroeconomic policies rather than an effective adjustment mechanism.

This view is consistent with the findings of Fratzscher and Stracca 12 . These authors come to the three following important conclusions:

- First, political instability negatively affects growth, through its effects on financial variables;

- Second, Italy is traditionally less stable than most countries in Europe;

- Third, the euro had shielded Italy against its own political instability, reducing the impact of negative, political events on financial variables.

- There is abundance of other possible causes of the slowdown.

Even a cursory literary review shows that there is an abundance of explanations of the Italian underperformance different from the €. What most of these explanations have in common is the insistence on structural factors. A potential weakness of these explanations is that structural factors are quasi-constant and it is difficult to explain a change, namely the slowdown in Italy’s growth, with a quasi-constant. The way to achieve consistency between quasi-constant structural factors and the trend reduction of growth in Italy is to note that some structural weaknesses did not allow Italy to adapt to some exogenous global change. In other words, there were structural weaknesses also before the Italian economy entered into its period of poor performance, but these became more damaging when they negatively interacted with exogenous changes.

There is no attempt here to explain Italy’s slowdown with the joint effect of structural factors and global, exogenous changes. What is relevant here is that there are quite plausible explanations of this slowdown in the literature 13 . In terms of impeding structural factors, the following are often mentioned:

- Poor Education,

- Insufficient R&D,

- Specialization in low growth, traditional sectors,

- Small firms size,

- Poor firm governance,

- Low level of trust,

- High level of corruption,

- Poor public administration, including the judiciary,

- A welfare system based on the protection of jobs job rather than workers,

- Geographic dualism between North and South.

In terms of exogenous global changes the emphasis is usually put on three interacting factors:

- Changes in international specialization and comparative advantage,

- Globalization, with large emerging economies, in particular China, entering the world market and producing traditional good at much lower cost,

- The ICT revolution.

In the interesting, firm by firm, empirical assessment of Calligaris and al. 14 the interaction between structural factors and exogenous changes leads to pervasive resource misallocation, which is, in turn, the main immediate cause of the productivity slowdown in Italy, leading in turn to the lower trend growth.

So, if anything, we have an embarrassment of choice in explaining the underperformance of Italy without having recourse to the €. Looking at the € is thus not simply useless, but actually damaging as it distracts from looking for the measures that could put Italy on a sustainable higher growth path. Disposing of the view that the origin of Italian stagnation has to be found in the € just helps to concentrate on its real causes. A systematic treatment of these causes is left for another time.

This post was written with the assistance of Pia Hüttl and Madalina Norocea and is also published on the Bruegel website.

- Author’s translation. The original is: “E’ l’ora di tornare alla lira: chiediamo un voto agli italiani”. Intervista a Repubblica . E allora, torniamo alla lira? “Io dico di non scartare questa ipotesi perché non è affatto peregrina. Anzi. Sono tre anni che l’euro, non per colpa sua ma per responsabilità di chi ha gestito il passaggio alla moneta unica, ha dimostrato di non essere adeguato di fronte al rallentamento della crescita economica, alla perdita di competitività e alla crisi dell’occupazione. Non è forse meglio tornare, temporaneamente, almeno ad un sistema a doppia circolazione?” [↩]

- Author’s translation- The original is: “Io ricordo, dopo la seconda guerra mondiale, che c’era in Italia una seconda moneta che è rimasta di fianco alla lira dal ’43 al ’53 – ricordava Io non dico di uscire dall’euro, ma non ho trovato nessuna norma nei trattati Ue che vieti l’adozione di una moneta nazionale e noi abbiamo già un nome: si chiama lira, il cambio lo da il mercato con l’euro, perché non fare una prova?” [↩]

- http://www.corriere.it/opinioni/17_marzo_28/insensata-uscita-moneta-unica-1dedd6b4-1322-11e7-be9a-6ca09ed8307d.shtml?refresh_ce-cp. Author’s translation. The original is: “Un dibattito europeo su come riorganizzarne, anche radicalmente, la gestione andrà avviato, e presto. Ma il nodo della campagna elettorale che si è aperta non è questo. La questione sarà: vogliamo che l’Italia esca subito e unilateralmente dall’unione monetaria e in prospettiva dall’Ue divenendo un paria dell’Europa?“. March 27th 2017 [↩]

- P. Manasse, The roots of the Italian stagnation. 19 June 2013. VOX, CEPR’s Policy Portal. The author refers this accusation but clearly does not believe in it. The rest of the quotation is as follows: “ This column argues that while the severity of the downturn is clearly a cyclical phenomenon, the inability of the country to grow out of it is the legacy of more than a decade of a lack of reforms in credit, product and labour markets. This lack of reform has suffocated innovation and productivity growth, resulting in wage dynamics that are completely decoupled from labour productivity and demand conditions.” [↩]

- McCallum (1990) defined super-neutrality in such a way. See McCallum, B.T. (1990). Inflation: theory and evidence. In: Friedman, B.M., and F.H. Hahn (eds.), Handbook of Monetary Economics, Vol.2. North-Holland, Amsterdam, pp.963-1012 [↩]

- Blanchard, O. and Summers, L. (1986), Hysteresis and European Unemployment, in Fischer, S. (ed.), NBER Macroeconomics Annual, MIT Press, September, pp. 15-77 [↩]

- O. Blanchard, E. Cerutti, and L. Summers, Inflation and Activity – Two Explorations and their Monetary Policy Implications IMF Working Paper, Research Department. November 2015 [↩]

- G. Cette , J. Fernald , B. Mojon, The Pre-Great Recession Slowdown in Productivity, Mineo January 15, 2015 [↩]

- F. Giugliano and C. Odendahl, Europe’s Make-Or-Break Country: What Is Wrong With Italy’s Economy? Center for European Reform. Policy brief, 19 December 2016 [↩]

- Was the € a good idea, Mark II?” March 21, 2017 in my Blog; Money Matters? [↩]

- Demertzis, K. Efstathiou and F. Matera, The Italian Lira: the exchange rate and employment in the ERM. Bruegel Blog, January 13, 2017 [↩]

- M. Fratzscher and L. Stracca. Does It Pay To Have The Euro? Italy’s Politics And Financial Markets Under The Lira And The Euro, ECB Working Paper Series No 1064 / June 2009 [↩]

- E. Soukiazis, P. A. Cerqueira and M. Antunes. Causes of the decline of economic growth in Italy and the responsibility of EURO. A balance-of-payments approach. Mimeo. P. Manasse. The roots of the Italian stagnation. 19 June 2013. VOX, CEPR’s Policy Portal. A. Mody and E. Riley. Why does Italy not grow? Bruegel BLOG POST October 10 2014. P. Manasse, T. Nannicini, A. Saia Italy and the euro: Myths and realities. 24 May 2014, VOX, CEPR’s Policy Portal [↩]

- Calligaris, M. Del Gatto, F. Hassan, G. I.P. Ottaviano and F. Schivardi. Italy’s Productivity Conundrum, A Study on Resource Misallocation in Italy. Discussion Paper 030 | May 2016. European Commission, Directorate-General for Economic and Financial Affairs [↩]