Responsibility for the spread lies, in the first instance, in national capitals, the ECB in Frankfurt comes second

Together with Leonardo Cadamuro 1

I. Introduction

The risk has increased of ‘fragmentation’ in the transmission of monetary policy in the euro-area, now that the European Central Bank has started increasing interest rates. Fragmentation refers to interest rates in different countries in the monetary union reacting differently when the ECB revises its interest rate. Fragmentation risk is measured by the differences in the yields of bonds issued by peripheral countries and those issued by core countries. The spread between the yields of Italian and German bonds has become a particular focus of attention.

The ECB has put in place a tool, the Transmission Protection Instrument (TPI), which can be activated when national policies are judged adequate by the ECB Governing Council but the spread remains excessive. While the TPI should protect against fragmentation, it could also obscure the critical issue: whether the countries concerned pursue growth-fostering and fiscally-sound policies, while avoiding any doubts about their wish to remain in the euro area.

In this post, using evidence relating to Italy, we advance the view that the ECB’s TPI is less important than national policies in protecting against the risk of fragmentation. Indeed, we pursue two main points: (i) the importance of national policies for the spread; (ii) government announcements of sound policies and a cooperative attitude towards European institutions are more important than ECB action in fighting fragmentation.

We document in particular that a national government that credibly announces growth-enhancing measures and has a collaborative attitude towards European institutions creates a positive expectation in investors about the safety of their investment, thus reducing the perception of the government bond’s risk. The result is a lower interest rate in future auctions and a decreased spread. The reverse also applies.

II. The effect of national policies on the spread

Of course, if all euro-area countries consistently followed sound policies and were in equally solid financial situations, there would be no fragmentation risk. There is a reason why fragmentation risk is greater for financially weaker countries, including Italy, Spain, Portugal and Greece, but not for financially stronger countries, such as the Netherlands and France. Ireland has shown it is possible to graduate from the former to the latter category.

National policies are, however, also important outside of the ideal world in which all euro-area countries share the same financial strength. To document this point, one can look at the experience of the five latest Italian governments: Renzi-Padoan (from February 22th 2014 to December 7th 2016), Gentiloni-Padoan (from December 13th 2016 to March 24th 2018), Conte-Salvini-Tria (so-called Conte I, from June 1st 2018 to August 20th 2019), Conte-Gualtieri (so-called Conte II, from September 9th 2019 to January 26th 2021), Draghi-Franco (from February 17th 2021 to July 20th 2022) 2.

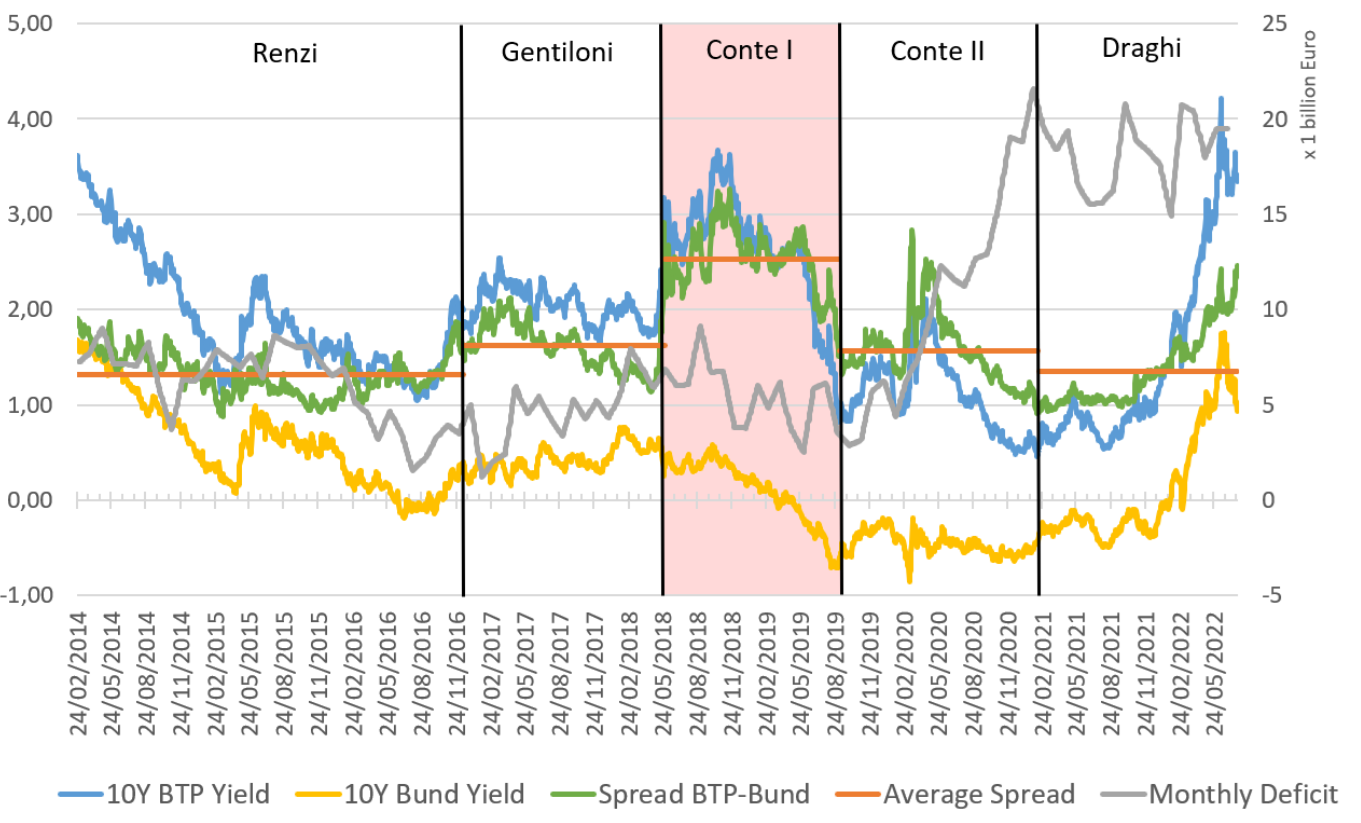

Figure 1 and the first row of Table 1 show the average spreads in yield of Italian relative to German bonds under each of the five governments. The average spread during the Conte I government was almost 100 basis points (bp) higher than the spread of about 150 bp points prevailing on average under the other governments. Given Italy’s high indebtedness, this translated into additional interest rate expenses of more than €20 billion per year, equivalent to more than 20% of Italy’s education expenses, or about 12% of health expenses (average values from 2012 to 2021). A higher spread also means a higher cost of credit for families and firms, undermining economic activity.

Figure 1. The yield on the German Bund and Italian BTP, the spread and the budget deficit along the latest four Italian governments.

Note: The monthly deficit (RHS) is smoothed as the average monthly deficit using 12-month rolling windows. The spread between Italian BTP and German Bund is calculated as: [(1+yI)/(1+yD )-1]x100, where yI and yD are respectively the yield on Italian and German 10-year bonds. Source: Banca d’Italia – Base dati Statistica (TCCE0100) for the monthly deficit (Fabbisogno delle Amministrazioni Pubbliche) and Bloomberg for the 10Y BTP and 10Y Bund yield time series.

Table 1: Average spread between Italian and German 10-year bond yields (in basis points)

| Governments | Renzi | Gentiloni | Conte I | Conte II | Draghi |

| Average Spread | 132 | 162 | 253 | 157 | 135 |

| ECB-adjusted Spread | 176 | 251 | 365 | 282 | 224 |

Source: Bruegel. Note: ECB-adjusted Spread refers to the ‘shadow interest rate adjusted’ spread; see the explanation in the text.

The spread difference between Conte I and the other four governments is the first evidence of the importance of national policies for the relative cost of public debt. One needs to look at possible explanations for the higher spread to dwell a bit further. Supply and demand for government bonds is the natural, logical framework to do this.

Figure 1 also shows the government deficits 3 corresponding to the 5 governments, to check whether it is fiscal policies, and increasing bond supply, that explain the higher spread during Conte I. There is no evidence of this: the first three considered governments, unaffected by the COVID-19 pandemic, had a similar deficit over GDP (2.4% for Renzi, 2.1% for Gentiloni, and 2.2% for Conte I) but only in the latter case there is a higher spread. At the same time, Conte I average spread is higher than during Conte II and Draghi governments, which faced the COVID-19 pandemic and increased dramatically the percentage of the deficit over GDP (5% for Conte II, and even 7.8% for Draghi) Thus, we get the apparently surprising result that a lower spread matches a much more expansive fiscal policy

Of course, some of the changes in the average spread shown in Figure 1 and the first row of Table 1 should be attributed to changes in the support deriving from the very expansionary ECB monetary policy.

One form of support was ECB purchases of Italian government bonds in the Asset Purchase Program (APP) and in the Pandemic Emergency Purchase Program (PEPP). Figure 2 shows that although the gross supply of government securities increased steadily from less than €1.8 trillion at the beginning of the Renzi government to about €2.3 trillion at the end of the Draghi government, ECB purchases led to a fall in the net supply of bonds to the private sector during the Renzi government. Subsequently, Italian government securities held by private investors remained roughly unchanged at around €1.6 trillion since the ECB bought practically all new issuance. Also, a higher supply of bonds to the private sector does not explain the higher spread during Conte I.

Figure 2: Gross and net supply of Italian government securities

Source: Bruegel based on ECB Statistical Data Warehouse and Banca d’Italia – Base Dati Statistica (MFN_VALM.M.52000200.100010.101.NOV.S1311.S0.WRDBI2.1000).

Note: Gross stock of securities (BTPs, BOTs, CCTs, CTZs, and Foreign Debts) issued by the Italian government (green line) and the net stock of securities issued by the Italian government minus the stock purchased by the ECB (blue line).

The effect of ECB’s monetary policy on the spread can also be measured using a ‘shadow interest rate’, which attempts to capture the overall stance of ECB monetary policy, including its various asset purchase programmes. The shadow rate declined continuously from about -0.6% at the beginning of the Renzi period, hit bottom at about -8% during the pandemic, and subsequently reversed sharply, to roughly -0.7% in August 2022.

To estimate what the average spread under each of the five Italian governments would have been if there had been no support from ECB’s monetary policy and the shadow rate had been zero we use the following equation:

Where Dk is the dummy for the governments ( from 1 to 5), st is the spread, it is the shadow interest rate and ut is an estimation error. All coefficients have the expected signs and are statistically significant at the 1 percent level. The bottom row of Table 1 shows the fitted values for the five periods, with the shadow interest rate set to zero. Here as well, taking into account the support from the ECB to Italy, because of its overall monetary policy, the spread during the Conte 1 government is even more than 100 basis points higher than during the other 4 governments considered here.

Thus, neither the gross supply of government bonds nor the amount corrected for all ECB policy measures explain the higher spread in the Conte I period. The remaining possible reason is market expectations about future government policies and thus future bond demand and supply: the market will demand higher spreads if it fears a government will not pursue growth-enhancing and fiscally prudent policies and will possibly raise the idea of exit from the euro area, engendering redenomination risk.

Thus another candidate to explain the higher spread in the Conte I period is market expectations about future government policies and thus future bond demand and supply: the market should be concerned and ask for higher spreads if it fears a government will not carry out growth-enhancing and fiscally prudent policies 4. Indeed, debt sustainability worsens as the economy’s growth rate and the primary surplus decrease.

While market expectations about growth and primary surpluses cannot be directly observed, we can look at proxies. In particular, what was the attitude of the different governments towards:

- The EU and its economic guidance and

- The balance between demand and supply enhancing policies.

Table 2 summarises our reading of relevant quotes from the introductions of the five Italian governments’ economic and financial policy statements.

Table 2: Summaries of Italian government announcements on five issues that shape market expectations of growth and fiscal policy, and on the impact of the COVID-19 pandemic

|

Government |

Change in debt ratio* |

Change in government |

Funding source |

Supply or Demand emphasis |

Attitude towards EU |

COVID-19 |

|

Renzi |

– |

– |

Yes |

Supply |

Collaborative |

No |

|

Gentiloni |

– |

– |

Yes |

Supply |

Collaborative |

No |

|

Conte I |

+ |

++ |

No |

Demand |

Antagonistic |

No |

|

Conte II |

++ |

++ |

Yes |

Both |

Collaborative |

Yes |

|

Draghi |

+ |

– |

Yes |

Supply |

Collaborative |

Yes |

Source: Bruegel based on Italian government Documento di Economia e Finanza and Nota di Aggiornamento del Documento di Economia e Finanza. Note: * + indicates a slight increase; ++ indicates a sharp increase; – indicates a slight decrease; — indicates a sharp decrease. The relevant excerpts (in Italian) from which we derived the conclusions in the table are available on request from the authors.

Table 2 shows that the Conte I government antagonized EU institutions (‘Italy first’ policy) and prioritised demand rather than supply-enhancing policies. In addition, strong statements from leaders of the parties supporting the government led the market to fear Italy would exit the euro (see for example interviews with Five Star Movement founder Beppe Grillo and with Matteo Salvini, who was subsequently deputy prime minister).

Instead, the other four governments pursued a cooperative approach with the EU institutions and gave more weight to supply policies, taking structural measures. In particular, while responding to the COVID-19 shock with very expansionary fiscal policies, the Draghi government managed to reassure markets and avoided the effects of the spread because its policies were considered necessary, temporary and in line with EU guidance. In addition, the Draghi government started to implement vigorously the supply-oriented, growth-increasing programme adopted under the Next Generation EU initiative. Of course, as was the case for the other governments, ECB purchases also helped contain the spread.

Therefore, market expectations about government policies are a plausible candidate to explain the higher spread during the Conte I government. Not surprisingly, it is not only the actual supply of and demand for bonds that determine the spread but also expectations about supply and demand.

In conclusion, market expectations about government policies are a plausible candidate to explain the higher spread during the Conte I government.

A direct comparison between the changes in the spread over the five Italian governments mentioned above and the effects of ECB action is fraught with difficulties. Indeed, the effect of national policies on the spread is gradual, while the announcements of ECB action are immediate and not necessarily long-lasting. Still, a quantitative view of the effects of ECB intervention announcements can help assess the relevance of domestic policies on the spread. This exercise is done in the following section.

III. The effect of ECB support on the spread

Various attempts have been made to measure the effect of ECB purchases on the spread between the bond yields of peripheral and core countries. The studies mostly consist of sophisticated event analyses, looking for effects in the immediate vicinity of different announcements.

Dewachter et al. (2016) 5 conducted an event study analysing the impact of ECB announcements about unconventional monetary policy, including asset purchases, on the spreads of Italian, Spanish, Belgian and French bonds relative to OIS (Overnight Index Swap) rates between January 2000 and June 2016. Their “main finding is that at the peak of the crisis, UMP (Unconventional Monetary Policy) announcements contribute to reduce on average the expected spreads by more than 20%.” This result is not directly comparable with the changes in the spread due to changing national policies and announcements, not only for the reason mentioned in the previous section but also because the sample period, January 2000 to June 2016, excludes the large purchase programs enacted after mid 2016. Still, it is useful to look at the detailed results in table 5 of the paper, which we report in table 3.

Table 3. Cumulative weekly variations in the two components of the spread for five years Italian yields around the announcements. Basis Points and percentage

| ECB measures | Basis Points | % of the peak Spread |

| SMP | -81 | -14 |

| (T)LTRO | -105 | -18 |

| OMT | -105 | -18 |

| FG | -33 | -6 |

| APP | -43 | -7 |

Source: Dewachter et al. Table 5.

Falagiarda and Reitz (2015) 6 also carry out an empirical analysis of the effects of unconventional policy announcements by the ECB on the spread between core and peripheral countries between 2008 and 2012. The study’s conclusion is that “ECB communications about unconventional monetary policy measures substantially decreased the perceived sovereign risk of stressed euro area countries, with the exception of Greece. … Not surprisingly, among the different types of unconventional operations, those introduced specifically to tackle sovereign debt tensions are found to be particularly effective in diminishing the sovereign spread.”

Drawing on their Table 4, we can summarize the effects on the Italian spread as in table 4.

Table 4. Cumulative daily variations in the spread for ten years Italian yields around the announcements. Basis Points and percentage

| ECB measures | Basis Points | % of the peak Spread |

| Sum of SMP events | -112 | -19 |

| Sum of OMT events | -84 | -15 |

Source: Falagiarda and Reitz. For column 1 and authors’ calculations for column 2.

The results of the two studies are similar. Since the effect of the measure should be approximately proportional to the size of the spread (for instance, it would be absurd to have a reduction of more than 100 basis points if that was the size of the spread to start with), the ballpark conclusion from looking at the two studies is that the relevant measures of the ECB reduced the spread by about one fifth.

Another gauge to assess the spread increase during the Conte 1 government, documented in the previous section, is to look at the impact effect of the “whatever it takes” statement by Draghi on July 26th 2012. On an intraday analysis, Rostagno et al. show a reduction of the 10 year BTP yield from around 6.35% to 6.00%, i.e a reduction of about 7.0% of the prevailing spread, around 4.85%. The effect continued over time and Rostagno et al. mention a reduction of 200 b.p. of the spread versus Germany by the end of the year, some 40% of the preexisting spread.

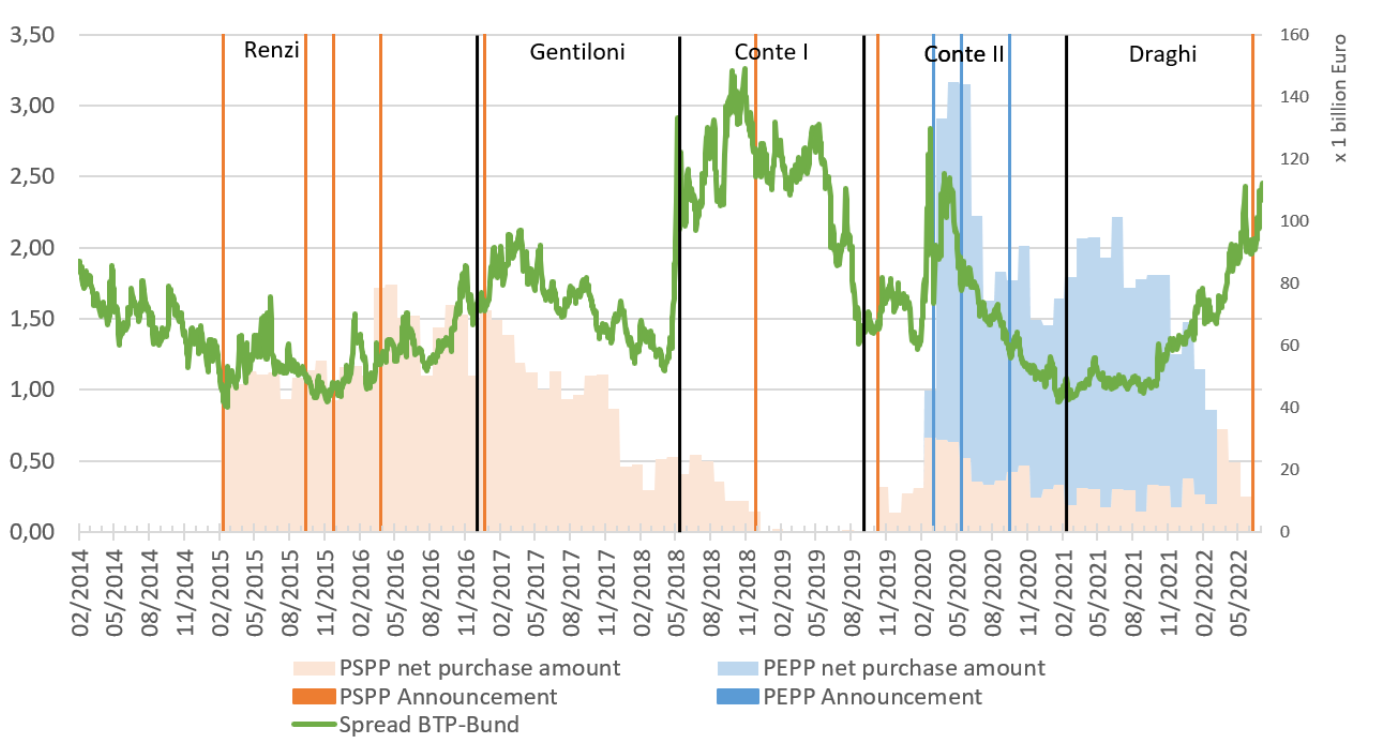

To check whether the experience in the most recent period shows very different results, we look at the impact of the ECB announcements and purchases on the BTP-Bund spread from February 2014 to July 2022, Figure 3 reports the BTP-Bund Spread and the main announcements of the ECB’s public sector purchase programme (PSPP) and the Pandemic emergency purchase programme (PEPP).

Figure 3. Main ECB’s announcements, BTP-Bund Spread and amounts of purchases.

Note: The spread between Italian BTP and German Bund is calculated as: [(1+yI)/(1+yD )-1]x100, where yI and yD are respectively the yield on Italian and German 10-year bonds. Source: Bloomberg for the 10Y BTP and 10Y Bund yield time series, ECB website for monthly PSPP and PEPP net purchase amount.

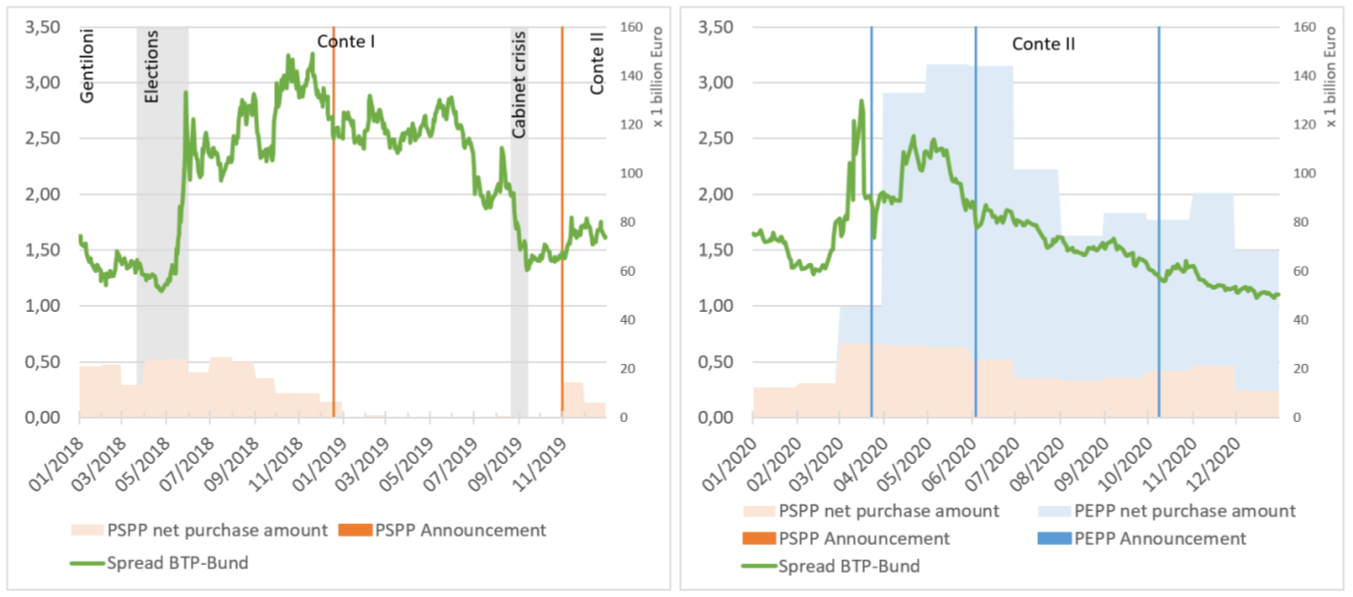

In Figure 3 the brownish and bluish vertical lines indicate the main announcements of the ECB about those programs. The histograms show the amount purchased. While the spread has had, in this period, significant ups and downs, moving within a range between 90 and 310 basis points, there are not many immediately visible large changes in the spread when announcements on the purchase program were made. To look closer, we focus on two periods when the BTP-Bund spread changed greatly: between March 2018 and August 2019 and February and October 2020.

In the first episode (Figure 4a), the spread sharp increase in April and May 2018 does not coincide with any announcement and is not correlated with any significant change in ECB’s net purchase amount, which continued the regular and slow decrease that had started in February 2018. Conversely, from late March 2018 to May 2018, the election polls showed increasing support for euro-sceptical parties (Lega and 5 Stars movement) favouring an “Italy first” policy that the Conte I government followed, supported by these two parties. Similarly, the subsequent sharp decline of the spread in the summer of 2019 contrasts with the ECB’s decision to stop new purchases in the Public Sector Purchase Program, part of the APP. Instead, in the summer, turmoil developed inside the Conte I government, which eventually fell in August 2019. The new government (Conte II) announced sounder policies and a cooperative attitude toward European institutions. Overall, in this first episode, there is no obvious evidence of an effect on the spread from ECB interventions, while national developments prevailed.

The second episode (Figure 4b) started in February 2020, when there was a considerable spike in BTP-Bund spread, followed by the PEPP announcement and massive interventions of the ECB. These resulted in an immediate large reduction in the spread by about 120 basis points, equivalent to more than 40% of the prevailing spread. The Conte II government had a positive attitude towards European institutions asking for more collaboration among European countries. Overall, in this second episode, there is evidence of an effect on the spread due to ECB interventions, while the impact of national policies is not clear.

These case studies show that the ECB can significantly affect the spread between core and peripheral countries. However, the impact is not systematic and is large only when a huge quantity of securities is purchased.

Figure 4. Main ECB’s announcements, BTP-Bund Spread, and amounts of purchases for two specific periods: (a) 2018-2019; and (b) 2020.

We need also to consider that the ECB must carry out purchases, in principle, according to the capital key, consisting of the share of the capital of the ECB held by different national central banks. Thus, it is difficult for the ECB to target purchases in specific countries suffering from a spread increase. A massive purchase program is easy to decide in the case of an external shock that affects, even if with different intensity, but in the same direction, most of the Eurozone, such as the recent pandemic or the Ukrainian crisis. It is more difficult in case of a shock affecting only one or just a few countries.

To conclude, the ECB can have an impact on the spread. Still, only huge amounts carried out in exceptional situations have a large effect. Furthermore, ECB’s interventions become problematic when peripheral and core countries diverge.

IV. Conclusions

The comparison between the spread outcome of the policies of the five latest Italian governments and the effects of ECB purchases on the spread shows that both are effective. As mentioned, a quantitative comparison is very difficult. However, the effects of ECB measures, on the downside, estimated between 20 and 40 % of the pre-existing spread, are smaller, in absolute value, than the 70 % effect, on the upside, of national policies of the Conte I government privileging aggregate demand, instead of supply, policies as well as an antagonistic attitude towards EU institutions while engendering doubts about future participation of Italy in the common currency.

Beyond the quantitative effect on the spread, it should also be taken into account that ECB purchases have benefits and costs, for instance, in terms of blurring the borders between monetary and fiscal policy. This is not the case with national policies, which only have benefits.

Our analysis shows that responsibility for the spread must be found, in the first instance, in national capitals; the ECB in Frankfurt comes second.

- An abridged version of this note was published on the Bruegel website, https://www.bruegel.org/blog-post/national-policies-are-best-protection-against-euro-area-financial-fragmentation-risks. We are grateful to Jeromin Zettelmeyer for precious suggestions.[↩]

- In practice, Gentiloni resigned on March 24th, remaining in a caretaker role until June 1st; Conte resigned for the first time on August 20th, remaining in a caretaker role until September 5th, while the second time, Conte resigned on January 26th, remaining in a caretaker role until February 13th; the Draghi government de facto ceased one week earlier than July 20th, when the Five Star Movement did not vote in favour of the government in a so-called confidence vote.[↩]

- The chosen specific measure of the deficit is the “Fabbisogno delle Amministrazioni Pubbliche”, which is the cash deficit of the general government, better representing the amount to be financed.[↩]

- Isabel Schnabel showed that growth has a very strong impact on debt sustainability. United in diversity – Challenges for monetary policy in a currency union. https://www.bis.org/review/r220615e.htm[↩]

- Hans Dewachter, Leonardo Iania, Jean-Charles Wijnandts, (2016), The response of euro area sovereign spreads to the ECB unconventional monetary policies. National Bank of Belgium Working paper. October 2016.[↩]

- Matteo Falagiarda and Stefan Reitz (2015), Announcements of ECB unconventional programs: Implications for the sovereign spreads of stressed euro area countries. Journal of International Money and Finance, 53, 276-295.[↩]