Hurray, a crisis!

The European phase of the Great Recession that started in May 2010 has produced huge damage: ask unemployed youngsters in Spain, the Exchequer in Ireland, banks in Italy and about everybody in Greece. There are two categories of people, however, that could welcome it: economists and naïve Europhiles.

Economists, with their limited ability with respect to natural scientists to carry out laboratory experiments, find in crises an occasion to test their hypotheses and formulate new ones, since relationships that were dormant or too weak to be seen in normal conditions emerge clearly in a crisis. Witness the enormous literature on the Great Recession, which is likely to be further enriched in the next decades: are we not still discussing, 80 years later, the Great Depression? Not only intellectually but also financially an economist can benefit from a crisis: her human capital becomes more profitable if she is seen as capable of providing some useful advice on how to deal with the crisis.

The story about naïve Europhiles is a little more complicated.

Jean Monnet, one of the fathers of the European Union, famously wrote in his memoirs «J’ai toujours pensé que l’Europe se ferait dans les crises, et qu’elle serait la somme des solutions qu’on apporterait à ces crises.» [1] I found a similar statement while sifting through the documents Tommaso Padoa-Schioppa left to the Archives of the European Union, when collecting material for his biography: Padoa-Schioppa wrote of a tightening of contradictions, borne out of the decision of Delors to anticipate financial liberalization, leading to a positive outcome like the single currency. So, both Monnet and Padoa-Schioppa think that crises generate the discontinuities within which progress towards European Union is achieved. And Monnet´s and Padoa-Schioppa´s thesis is well borne out by the decades long history of the European Union, where each crisis was an occasion of progress.

Bergsten and Kirkegaard [2], in one of the most perceptive papers I have read on the European crisis, develop Monnet´s and Padoa-Schioppa´s hypothesis into what they call the “only on the brink theory”, according to which, to surpass the crisis, a cession of sovereignty from the member states is needed and this is only possible under the duress of a crisis, when one is on the brink of a disaster. And one can argue that the “only on the brink” theory is a specialization of the dictum “if it ain´t broke, don´t fix it”. A crisis is the ultimate proof that something is broken and should be fixed. Therefore crises are an occasion of progress. Hence the hurray from the naïve Europhile.

I consider myself a Europhile, but not a naïve one, so I do not indulge in hurrays for the crisis. I see the risk of recognizing the need to change only when one is close to the brink and I am aware of the damage of crises. Still the crisis is here and the relevant question is whether we are now wasting it or exploiting in the Monnet/Padoa-Schioppa sense. Another way to ask the same question is whether we are reacting fast and decisively enough, given that we are unable to take a proactive attitude and are thus condemned to a reactive one.

If you think you have read enough of this post, the answer to my question is: the speed and intensity of reaction has not been good so far but it has been (barely) sufficient and, if we will be able to sustain it long enough, the Monnet/Padoa-Schioppa hypothesis will be verified again. However, if we will stop progressing, or even worse we will be backpedal, the damage will be much bigger than proving the two great men wrong.

For patient readers, I can organize the assessment of the speed and intensity of reaction to the crisis under three items:

- Economic adjustment,

- Financial/monetary repair,

- Institutional innovations, in

a) Economic and fiscal union,

b) Banking union,

c) Mutualizing idiosyncratic shocks.

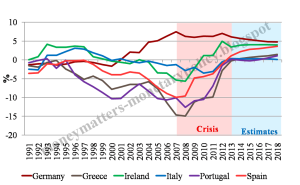

As regards economic adjustment the message is that important flow variables, like the current account (see chart below) and the budget deficits, are being corrected while stock variables, like public debt and external debt, not surprisingly, are not adjusting as yet, being by construction much more inertial. Add to this that the external competitiveness of the peripheral countries is improving, as confirmed by their brisk export growth, and you get the positive side of things. On the negative side, you have the macroeconomic conditions of the euro area: currently anaemic in aggregate terms, divided between a South in recession and a North in more satisfactory conditions and lacklustre going forward. The ECB expects stabilization of activity at low level for the aggregate euro-area, which is better than a recession but just not good, while it does not dare put out a favourable prospect about the North-South divide or long term growth.

Current account balances (% of GDP)

|

| Source: IMF, WEO database |

The repair in the financial and monetary field progressed in two crucial respects:

a) the ECB has reduced, through its very long term repo operations, probably close to a normal level, the risk that a solvent bank would become insolvent because of illiquidity.

b) the sheer announcement of the Outright Monetary Transaction program has drastically reduced the spreads between the yields on peripheral government securities and those of Germany. Thus the risk that solvent governments would become insolvent because of an excessive cost of their debt has been eliminated and the fragmentation in the transmission of monetary policy has been attenuated. Still monetary policy is asymmetric: tighter in the periphery that is in recession and looser in the core that is not.

Institutional innovations have taken place, albeit in different ways and intensity, in economic and fiscal union, in banking union and in the mutualization of idiosyncratic shocks.

In the area of economic and fiscal union, it is expected that the Six pack, Two pack, MIP (Macro Imbalances Procedure), Fiscal Compact, European Semester, Euro Plus Pact, having learnt the lessons of the failure of the Growth and Stability Pact, will not end up just being a razzmatazz of acronyms and jargon but will improve the economic governance of the euro-area by giving more powers to the European Commission, addressing much earlier the national budgetary plans at EU level, extending the EU process to structural measures.

In Banking Union, after years of resistance and denial, a single rule book is in sight, the nearly revolutionary decision to ask the ECB to become the dominant bank supervisor in the euro-area (and possibly beyond if some non euro-area countries will chip in) is being implemented, negotiations about a single resolution mechanism have entered into their concrete phase and it is only on the common deposit guarantee scheme that there is no progress. The going is tough: I presented some of the risks for the ECB in taking the responsibility of banking supervision in a previous blog [3]; progress in the areas of resolution and deposit guarantee is difficult because there is inevitably, directly or indirectly, the risk of an impact on national budgets; negotiations are tense, but the direction is right and, after years of stall, the pace is sufficient.

The down to earth expression “Mutualisation of shocks” is not part of EU jargon, which prefers the nobler expression of “Solidarity”, but it is a much more precise description of what the euro area needs. Europe does not need Robin Hood transfers, from rich to poor, to support monetary union, it rather needs a mechanism substituting the exchange rate in offsetting the idiosyncratic shocks that hit different parts of the euro area. Without calling them that way, two forms of mutualisation mechanisms have been provided during the crisis, one more explicit the other less. The more explicit mutualisation tool is the European Stability Mechanism, which was preceded and for some time complemented by the European Financial Stability Fund. Three years into the crisis, the 500 billion euro that the ESM has at its disposal to extend support to member states are used only to the tune of 30 billion (plus 40 billion for Spanish banks), leaving quite some resources to deal with new cases. The less explicit form of mutualisation, which was at its peak actually more than twice as large as the ESM potential [4], is the funding of banks in peripheral jurisdictions extended by the ECB. Both the support provided by the EFSF and the ESM as well as that provided by the ECB are not only very large in amount, they are also very cheap. Just consider that the ECB currently lends money to banks in stressed jurisdictions at rates of 50 basis points, which is arguable just a fraction of what these banks would have to pay to get funding in the market, if they could indeed get this funding at any cost.

While I hope I have provided some support to my bottom line that “the speed and intensity of reaction has not been good so far but it has been (barely) sufficient”, the one thing I still should do is to list the three main risks to a continuation of the progress achieved so far. In rough order of intensity I would identify them as follows:

a. Adjustment fatigue in peripheral countries – the political difficulties, in Greece, Portugal, Spain Italy and even in Ireland, in continuing with fiscal correction and, much more importantly now, with structural reform witness of the dimension of the risk that one or the other country may stop pursuing the necessary policies.

b. Institutional innovation fatigue – the difficulties in progressing on banking union are the clearest symptom that there are, inevitably, big hurdles to achieve the needed institutional innovations. The cautious attitude of Germany in this domain is understandable, but the border between doing things with the necessary care and delaying them to the point of losing effectiveness is a blurred one.

c. The lack of growth in Europe and the North-South divide create a strong headwind, making everything more difficult.

At the end, notwithstanding the risks, my sense is that before too long we will be able to add new observations to the decades of data validating the Monnet/Padoa-Schioppa hypothesis.

[1] “I always thought that Europe will be made through crises, and that it will result from the accumulation of solutions that will be given to such crises.”

[2] Peterson Institute Policy Brief 12-18, The Coming Resolution of the European Crisis: An Update. June 2012.

[3] Money matters? Monetary policy. blogspot, Is the ECB a central bank over burdened with risk?,

[4] As measured by so called Target balances, see: Target balances and the risk of another„Reparations“ problem