Greening central bank action

On October 12th I participated to a virtual conference for financial industry participants in which I presented my thoughts about the possible greening of central bank action. This is the (updated) text of my speaking notes.[*]

I. Introduction

I see four approaches central banks, and in particular the ECB, could take towards green issues and in particular towards the idea of greening their action in both the monetary and the supervisory field:

- The aloofness approach – i.e. ignore the issue,

- Take the issue into account to the extent needed to better pursue the primary objective (both in the monetary policy and bank supervision areas),

- Take the issue into account as a secondary objective if it does not cause prejudice to the primary objective,

- The climate-panic approach – make it the primary objective.

Let me quickly dispose of both the aloofness and the climate-panic approach.

Clearly the aloofness approach would not be consistent with the objective importance that the green issue has acquired: it would be inconceivable that central banks would ignore what is arguably the gravest global problem. Furthermore, such attitude would not be consistent with appropriately pursuing the primary objective of the ECB, price stability, as well as the prescription to contribute to the other objectives of the Union when this does not conflict with the primary objective. Such attitude would also be disastrous in terms of reputation: the general public would not understand how the central bank could call itself out of the critical and difficult effort to avoid climate disaster. The recent speech by Isabel Schnabel, Member of the Executive Board of the ECB, makes this, and other important points, very clear.

The rejection of the climate-panic approach derives immediately from the ECB statute, which gives the first rank to price stability. But this approach would also make no sense from an economic point of view. A little anecdote can help me make the point. In 1999 I wrote a little popularizing book with a co-author (Carlo Santini) about the ECB. To explain the assignment to the central bank of the objective of price stability, among all those established by the Treaty, I argued that it would have made no sense to assign to it the environmental objective, given the weak link between that objective and the tools at the ECB’s disposal. Indeed, if the central bank had as primary objective the environment, the only thing it could do would be to keep the economy in a state of permanent recession: the experience during the pandemic is that the very deep recession that it caused led to a significant improvement of the environment. My example about the wrong assignment of environment protection to the ECB cannot be found in the current seventh edition, lest someone misinterpret me as supporting the aloofness approach.

I think the second approach, i.e. taking the issue into account to the extent needed to better pursue the central bank statutory objective, price stability for the monetary area and financial stability for the supervisory area, should obviously be followed. This statement of principle, however, requires quite some work to be properly specified. Much of my presentation will be exactly devoted to explore this issue.

The third approach, i.e. considering the environment as a secondary objective and thus going beyond just recognizing the impact of environmental issues on the pursuit of the first objective, should also, in principle, be followed. However, transforming this principle into concrete formulations is difficult and I think that we are just at the beginning of the process to operationalize it. My attempt to contribute to this process will take another substantial part of my time.

II. Take the issue into account to the extent needed to better pursue the primary objective

To specify the second approach, we can break down the overall issue in four sub-issues:

- Facilitate and require exhaustive information,

- Promote awareness of environmental issues in the financial world,

- Greening monetary policy action,

- Greening supervision.

The first sub issue, about information, is as obvious as complex. The proof of the complexity is that, notwithstanding a lot of investment in the endeavour to provide precise information about green issues, the issue is far from straightforward. Let me report just three pieces of evidence here.

The first piece of evidence is about the EU taxonomy. The technical group released, in March of this year, its 66 pages report and its 593 pages technical annex on recommendations on the design of the EU’s “green list”. This covered just 2 of the 6 topics to be eventually included in the taxonomy: Climate change mitigation and Climate change adaptation. Technical criteria for the other four topics, Sustainable and protection of water and marine resources, Transition to a circular economy, Pollution prevention and control, Protection and restoration of biodiversity and ecosystems, will only be issued by the end of 2021. The sheer size of the documentation witnesses the complexity of the issue.

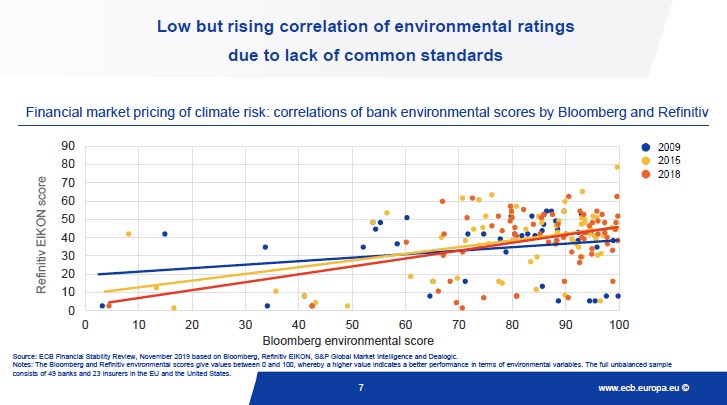

The second piece of evidence consists of the following chart, drawn from the speech of Isabel Schnabel. The chart shows how low, while fortunately rising over the last 9 years, is the correlation between two important sources of environmental scores: just to take an extreme example, still in 2018 Bloomberg gave to some assets a value of 90/100 or more, Refinitiv gave them less than 10/100. On average, the correlation between the two scores did not reach, again in 2018, 50 per cent.

Source: Isabel Schnabel. When markets fail – the need for collective action in tackling climate change.

Source: Isabel Schnabel. When markets fail – the need for collective action in tackling climate change.

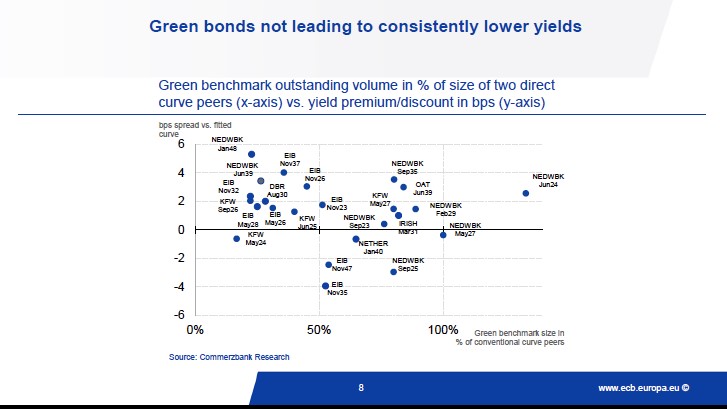

The third piece of evidence is about the “green spread”, in particular about its existence, size and origin. Here the evidence is, in my view, mixed. I have seen some claims that the yield on green bonds is lower than the yield on similar “normal” assets. My colleague at Bruegel, Dirk Schoenmaker, has even put forward the idea that this spread could support a market for green certificates that, assorted to a normal bond, would be a more liquid asset than a green bond. Others dispute the result that the green qualification lead to lower cost of issuing bonds. The following chart, again from the speech of Schnabel, confirms the ambiguous result: green bonds normally have lower volumes while the spread is most of the time positive instead of negative, arguably because of lower liquidity. As for the reason behind a possible green spread there are two possible interpretations. The first one points to the desire of investors in green bonds to “do good” and accept a lower yield for the sake of the environment. The second interpretation is that green bonds are less exposed to “brown” risk, which justifies the lower yield[†]. I tend to put more weight on the second reasoning, but I think available evidence does allow to exclude the first one.

Source: Isabel Schnabel. When markets fail – the need for collective action in tackling climate change

Of course, dealing with the information issue is not the exclusive responsibility of the ECB, indeed it should have a complementary rather than a primary role. Still, given the prowess of its economic and statistical departments it can effectively contribute to advancements in this area.

When it comes to the second sub-issue, namely promoting awareness of environmental issues in the financial world, Andrea Enria underlined two weaknesses of market participants in properly assessing climate risk: the “tragedy of the commons”, i.e. the inability to properly take into account the externalities connected to economic activities, and the “tragedy of the horizon” or the short termism of most financial market participants. To address these weaknesses the ECB has prepared a 45 pages “Guide on climate-related and environmental risks”, specifying that it is not compulsory, while clarifying in the sub-title that this defines the “Supervisory expectations relating to risk management and disclosure”. The potency of ups and downs of central bankers eyebrows to impress bankers is not what it used to be. Still I think the 45 pages will be taken seriously by banks.

Let me now move specifically to one of the two fundamental tasks of the central bank: monetary policy. I see at least three areas in which keen interest on and analysis of environmental issues is needed to properly pursue the primary objective of monetary policy, namely price stability.

First, no proper macro modelling and forecasts can be conducted without taking into account the influence of environmental issues. Both in the case in which sufficient action is taken to forestall the environmental catastrophe and the case in which this is not done, the correct forecasting and identification of shocks relevant for both inflation and growth outlook cannot be done without taking into account environmental developments.

Second monetary policy implementation will become more complicated, as extreme events will be more frequent and the central bank will find out it does not have enough space to deal with them. In addition, there could be more frequent episodes in which climate issues produce supply shocks and central banks face a tradeoff between stable prices and output.

Third, the central bank has to take into account the risk that environmental changes, or the need to deal with them, will cause losses, possibly substantial ones, on its “brown” assets. The risk of stranded assets is as serious for the central bank as for other financial entities. This should be duly taken into account in all investment activities of the central bank: pension fund, own funds, international reserves and monetary portfolios. President Lagarde recently mentioned that this could imply moving away from the “neutrality principle”, i.e. purchasing private bonds according to their outstanding amounts. This would go in the direction proposed by Schoenmaker. The risk of brown assets applies, albeit in different form, when they are used as collateral.

As regards the other fundamental tasks of the central bank, namely maintaining financial stability, I would like to mention just three points.

The first one refers to the risk of brown (and eventually stranded) assets in portfolios of banks and other financial intermediaries. We know that market economies, and in particular their financial sectors, are extremely efficient machines, but have intrinsic fragilities, as the experience of the Great Recession confirmed. It is not far-fetched to imagine that environmental developments could produce such changes in the value of assets in the portfolios of financial institutions that their buffer would not be able to offset them. This could indeed also be the case in which action to deal with the environment problem, say a late and sharp increase of carbon pricing, would drastically decrease the value of some assets.

The second point is in a way a generalization of the first one. A drastic depreciation of financial assets due to environmental developments, be they equities or fixed income, could affect the wealth of households, either directly or through pension funds and other institutional investors. Similar phenomena could be conceived for real estate: where would the value of “brown” buildings go if there was a substantial revision of environmental prospects? What would be the consequences for households, mortgage lenders and investors in Real Mortgage Backed Securities and mortgage covered bonds?

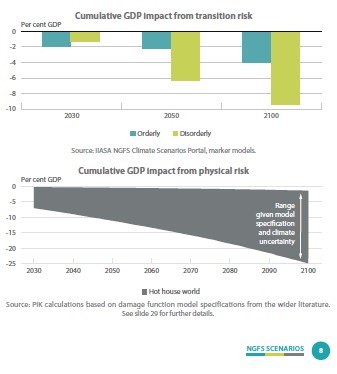

The third point is about having clarity on the impact of different climate scenarios on the macroeconomy and the financial system. This is the task given to the Workstream on Macrofinancial of the Network for greening the financial system[‡], which now includes more than 70 participants from the original 8 central banks. The report of this workstream examines three scenarios: an orderly scenario, in which timely action is implemented to meet the climate goals specified in the Paris agreement; a disorderly scenario in which the climate goals are achieved, but only thanks to sudden, unanticipated and late action; a “Hot house world” in which insufficient action is deployed to deal with climate damage. As shown in the chart drawn from the Workstream, in the first scenario the long term (2050) GDP loss is very limited and even a positive change cannot be excluded. In the disorderly scenario the loss is about three times the one in the orderly scenario, while in the “Hot House World” it is catastrophic, more than 10 per cent.

It is clear that the financial stability implications of the three scenarios are hugely different and there is little consolation in the fact that the economic consequences would take decades to fully develop: financial market have the ability to wake up, suddenly and unexpectedly, to risks, even if they are in the distant future.

III. Take the issue into account as a secondary objective

Let me now come to my third approach, i.e. the one where the central bank takes the issue into account as a secondary objective if it does not cause prejudice to the primary objective. As I mentioned, one can share this option, but it is definitely very difficult to operationalize, to precisely understand what it means in practice.

I would like to start with three general considerations before moving to more specific, operational aspects.

The first general consideration is that the difficult of operationalizing this principle comes from the fact that one has to check very precisely whether indeed one or the other green initiative causes “prejudice” to the primary objective of price stability.

The second general consideration is that the central bank would most probably not need to operationally pursue environmental issues as a complementary objective if we were in a first best world. If indeed there was a global carbon price adequate to reach the Paris Agreement goals (say 40 to 60 $ per ton of CO2 now and 50-100 in 2030) the central bank should, to a large extent, count on private agents, including financial ones, to internalize, through carbon pricing, the externality of their behaviour into their actions. The central bank should arguably still engage into facilitating and requiring exhaustive information as well as promoting awareness of environmental issues in the financial world, as discussed above, but could in all likelihood stop there. However, this ideal world is far from being implemented and therefore the issue of a practical involvement of the central bank cannot be easily disposed of.

The third general consideration is that the large uncertainty about many aspects of climate change and its repercussions on the financial sphere suggests two advices:

- Work very hard to reduce the uncertainty,

- Calibrate action consistently with the success in reducing uncertainty.

The corollary of the second advice is that one should engage progressively into climate targeting operations: what may be premature today could very well become advisable tomorrow when more progress will have been made in reducing uncertainty. I will give an example of this when addressing the possibility for the ECB to engage in Green LTROs[§].

In what follows I will try to translate my general considerations into something more specific regarding four specific operational issues:

- The ECB as a large-scale investor

- The idea of having green LTROs

- The possibility to have less stringent risk mitigation measures on green assets used as collateral

- Imposing lower capital charges on green assets held by banks;

Let me, however, warn you that, on most of these issues I will not be able to reach very firm conclusions. I come back to my point about calibrating action on the amount of information we have.

On the actions of the ECB as a large-scale investor, I think Coeure[**] has very perceptive comments, that I would summarize as saying that green considerations should be stronger depending on the distance of the specific central bank portfolio from monetary policy, to be sure that it does not cause “prejudice” to the primary objective.

In light of this idea, greening the pension fund of the central banks and also its own funds, a sort of equity of the central bank, should be uncontroversial, it is difficult to see how this could damage the effectiveness of monetary policy and thus potentially impair the pursuit of price stability. The balance between pursuing the green objective and the effectiveness of monetary policy looks different for the other two, largest, portfolios of the central bank: foreign reserves and the monetary policy portfolios. Schoenmaker proposes to move away from market neutrality, i.e. buying bonds according to their share in the total relevant market, which inevitably generates a brown bias, by “tilting” purchases towards bonds issued by green firms. As mentioned, President Lagarde issues some favourable comments to this course of action. I think caution is needed to proceed in this direction: the market for bonds issued by green firms may not have, at least for the time being, the size and liquidity needed for portfolios used for macroeconomic purposes. Substantial moves into this direction will only be possible when the market for “low carbon bonds” will have substantially developed.

Analogous considerations apply to the idea of green Longer Term Refinancing Operations from the ECB. A first caveat here is that the provision of central bank refinancing could become complicated and the central bank would fully enter into a resource allocation mode. It is true that a step in this direction has already been made with the Targeted Longer Term Refinancing Operations, which favour lending to non-financial firms with respect to other possible borrowers, but the move into that direction that would be needed to green LTROs would be more significant and, in my view, arguable. A second caveat is that, applying by analogy the results of Ehlers, Mojon and Packer, it is not clear that favouring green loans would have the desired effect of reducing carbon emissions. Indeed, the three BIS authors show the, ex-ante surprising but ex-post obvious, result that not necessarily a firm issuing a green bond is a green firm: there are many other activities different from the one financed with the green bond that could make the firm definitely brown. An alternative, moving by analogy into the direction suggested by Zachman, would be to favour banks that lend to green firms. But it remains to be seen how straightforward this would be. Yet another caveat is that the inconsistencies in the definitions of green bonds, that would also apply to green loans, would make the full exercise more complicated and open to controversies. Jens van ‘t Klooster argues that the EU taxonomy would serve for this purpose, but my look at the taxonomy report has not convinced me that this would really deal, given the current level of development, with the problem. Implementation issues would be much more manageable if the greening of ECB lending was applied, on a pilot basis, to green mortgage lending, as van ‘t Klooster proposes as initial step.

Yet another possible change would be to attenuate risk mitigation measures on green assets used as collateral for refinancing operations with the central bank. The question is whether to do this beyond what is objectively needed to reflect the possible lower riskiness of green assets with respect to brown assets. The hurdle to take this measure looks smaller than either greening the monetary policy portfolios or the refinancing operations. The damage to the conduct of monetary policy operations deriving from the higher risk implicit in less stringent risk mitigation measures does not look significant, provided the favouring of green assets is limited. The acceptance by the ECB as collateral of sustainability linked bonds already goes into this direction.

Analogously, moderately lower capital charges for banks’ green assets could be seen as a way to incentivize banks to internalize the favourable externalities from green lending;

IV. Conclusion

In conclusion, my position about greening central bank actions looks quite conservative and indeed I am quite conservative when it comes to central banking issues. But I don’t present my position as immutable and definitive. I think the issue of the attitude of central banks towards green issues is very important and I warmly welcome a discussion on it. All the papers that are produced in this area thus fulfill a very important function. Only through an animated, but well-argued and documented, discussion can we hope to come to adequate conclusions on this difficult topic.

References

Benoit Coeure: Monetary policy and climate change. November 8th 2018. https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp181108.en.html

ECB to accept sustainability-linked bonds as collateral. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200922~482e4a5a90.en.html

Enria, A. (2020), “ECB Banking Supervision’s approach to climate risks”, keynote speech at the European Central Bank Climate and Environmental Risks Webinar, 17 June.

European Central Bank Public consultation on the draft ECB Guide on climate-related and environmental risks. https://www.bankingsupervision.europa.eu/legalframework/publiccons/html/climate-related_risks.en.html

EU Green taxonomy. https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-sustainable-activities_en

Green bonds and carbon emissions: exploring the case for a rating system at the firm level BIS Quarterly Review. September 2020. 14 September 2020 by Torsten Ehlers, Benoit Mojon and Frank Packer

Isabel Schnabel. When markets fail – the need for collective action in tackling climate change. https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200928_1~268b0b672f.en.html

Greening monetary policy: An alternative to the ECB’s market-neutral approach. Dirk Schoenmaker, February 21 2019. https://www.bruegel.org/2019/02/greening-monetary-policy-an-alternative-to-the-ecbs-market-neutral-approach/

Green TLTROs: Green, Targeted and Long-Term Refinancing Operations (draft). Positive Money Europe & Sustainable Finance Lab. Jens van ‘t Klooster (KU Leuven and University of Amsterdam). 2020.

Network for Greening the Financial System Technical document: A Status Report on Financial Institutions’ Experiences from working with green, non green and brown financial assets and a potential risk differential. May 2020. https://www.ngfs.net/sites/default/files/media/2020/06/29/ngfs_status_report.pdf

Network for Greening the Financial System. https://www.ngfs.net/en/about-us/governance/origin-and-purpose

Georg Zachman, Redefining European Union green bonds: from greening projects to greening policies. https://www.bruegel.org/2020/09/redefining-european-union-green-bonds-from-greening-projects-to-greening-policies/

[*] Useful comments have been received from Dirk Schoenmaker, Alexander Lehmann and Jens van’t Klooster.

[†] The NGFS Status Report on Financial Institutions’ Experiences from working with green, non green and brown financial assets and a potential risk differential, of May 2020, did not find evidence of lower risk for green assets, but neither could it conclude that this is not the case.

[‡] Network for Greening the Financial System. WS2 – Macrofinancial workstream Mandate and workplan from April 2020 to April 2022

[§] Jens van ‘t Klooster 2020.

[**] Coeure…