Government-guaranteed bank lending: beyond the headline numbers

Loan guarantees have been a major part of the COVID-19 support packages offered by European governments to companies. The actual take-up numbers so far follow very different patterns from the headline announcements, and might allay early concerns about single market distortions caused by the different sizes of packages in different countries.

Loan guarantees, complemented in some countries by public buying of corporate bonds, have been one of the main instruments with which European countries have acted to mitigate the liquidity shock facing businesses during the COVID-19 lock down. In many countries, such programmes represent more than half of the announced rescue funds1. They form a complex picture since they are typically provided through a number of different national programmes in each country, and in some countries are managed on a highly decentralised basis. Our ongoing research seeks to understand this picture at a granular level in France, Germany, Italy, Spain and the United Kingdom. This blog post presents our preliminary findings on the early implementation of the programmes.

With few exceptions, these programmes have been reported as headline announcements. For example, early in the COVID-19 outbreak, on 23 March, the German federal government announced two guarantee programmes, backed by a €756 billion envelope2, as part of its broader coronavirus package. One day later, the Spanish government made a similar announcement, with the headline number of €100 billion for guaranteed loans.

Our findings suggest that such headline numbers are not necessarily correlated with actual commitments to individual companies. Nor are these aggregate commitments aligned with the amounts estimated by the European Commission for the purposes of state-aid control. For example, in mid-May the Commission said that overall state aid provided by Germany would be a disproportionate 51 percent of the EU total (of which guarantees were a large share), prompting the Commission’s Executive Vice-President Margrethe Vestager to express concern about potential cross-border competitive distortions. Further concerns have been formulated since March by various observers that more highly indebted EU countries would be fiscally constrained in extending business assistance, thus putting companies established in their territory at a competitive disadvantage.

In fact, as Figure 1 illustrates, the pattern of distributions appears reassuringly (from a single-market standpoint) uncorrelated with government debt burdens or perceptions of sovereign fiscal space. In particular, the amount of credit support committed so far in Germany appears to be comparatively small – amounting to less than 1% of GDP (Figure 2) by the end of our period of observation. This is the lowest share among the countries we surveyed. The lack of data about regional programmes means we might be missing part of the picture, but we doubt it would change dramatically 3.

Figure 1: Government-backed credit support to businesses (€ bns)

Figure 2: Government-backed credit support to businesses (% 2019 GDP)

Figures 1 and 2 show the evolution of government-backed credit support under the various programmes in the different countries. This is mostly in the form of loan guarantees, except in the UK where the corporate debt purchase programme amounts to a third of all credit support to businesses (see Table 1). In Spain, guarantee programmes cover both bank loans and promissory notes, though the latter amount is relatively small4.

For credit guarantee programmes, Figures 1 and 2 report the full nominal amount of the credit covered by the public guarantee – ie 100% of the credit (eg loan) amount even if, say, only 70% of it is covered by the guarantee. The data presented in Figures 1 and 2 exceeds the amounts of guaranteed loans actually paid out, because businesses may obtain a bank’s agreement for a guaranteed loan, but then opt to not use it. In Germany, for instance, about a third of KfW-guaranteed loans that have been approved has not yet been used.

Table 1 lists all the programmes included in Figures 1 and 2.

Table 1: Government-backed credit support programmes to businesses included in the analysis

What drives the patterns displayed in our findings remains to be fully analysed. It is, in any case, notoriously difficult to disentangle the respective roles of supply of, and demand for, bank credit in driving lending volumes, especially in times of turmoil, as currently. On the supply side, issues of administrative capacity and programme conditionality probably play a part and can only be identified through highly granular analysis. On the demand side, the availability of liquidity buffers and of other sources of public support – such as grants and wage replacement schemes – are likely important drivers. What seems clear so far is that national fiscal capacity has not played the main role.

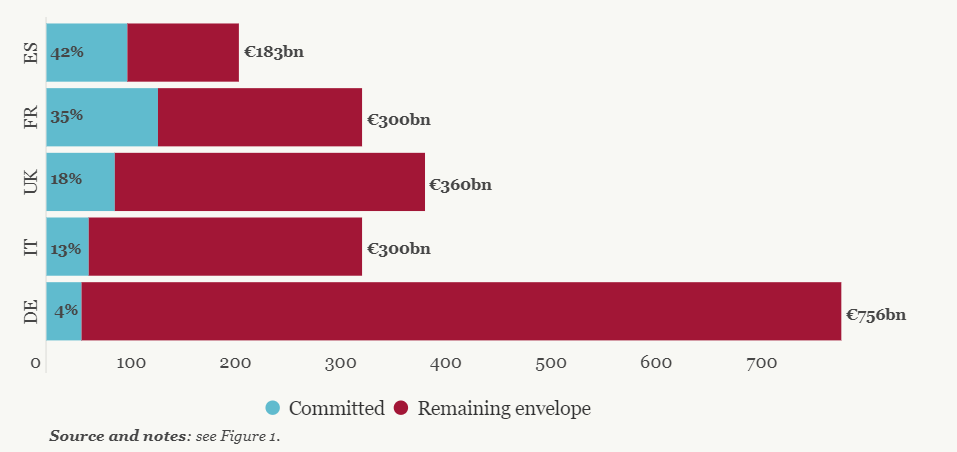

There is no positive relationship between the headline envelope of programmes as initially announced and their later take-up. That is not to say that the size of the envelope does not matter: large headline envelopes might have been announced with an eye to re-assuring markets.

Figure 3: Credit support as % of headline envelope, as of 22 June 2020

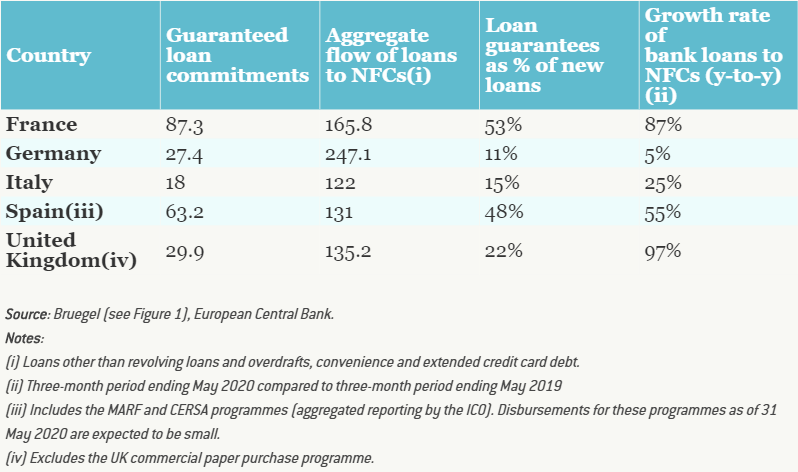

Table 2 compares loan guarantee commitments with the total flows of bank loans to non-financial corporations (NFCs) in the observed countries, from March to May 2020. Since the start of the crisis in March, bank loans to NFCs have accelerated significantly and loan guarantees make up a significant share of that growth. This does not seem consistent with the fear that banks are just substituting guaranteed operations for pre-existing lending.

Table 2: Loan guarantees and bank lending to non-financial corporations, new business, March to May 2020 (€ bns)

In future analysis we intend to assemble and interpret more information on the size, design, eligible banks, bank incentives, the sectors/types of firms benefitting from the guarantees under the different national programmes, and whether they fit into an EU framework.

We also plan to record how these programmes are modified over time to adapt them to the exit from lock down and the possibility of more corporate insolvencies, with consequences in terms of, for example, corporate governance, fiscal costs and banking-sector implications. We aim to better understand these and other dynamics in forthcoming publications in the course of our research project.

At this early stage, we find some reason to be cheered by what we observe. When it comes to actual use by business of government-backed credit facilities, negative scenarios of cross-border market distortions driven by countries’ different fiscal capacities appear to have been generally avoided so far. That’s a ray of sunshine in an otherwise challenging environment.

This post was prepared with the assistance of Julia Anderson and Nicolas Véron. The authors thank Youssef Salib for excellent research assistance.

Recommended citation:

Anderson, J., F. Papadia and N. Véron (2020) ‘Government-guaranteed bank lending: beyond the headline numbers’, Bruegel Blog, 14 July, available at www.bruegel.org/2020/07/government-guaranteed-bank-lending-beyond-the-headline-numbers/

- Such is the case in France, Germany, Italy, Spain and the UK.[↩]

- The envelope includes two elements: a €356 billion increase to the guarantee fund of the public financial institution Kreditanstalt für Wiederaufbau (KfW); and €400 billion for guarantees to large firms through the Economic Stability Fund (WSF, for Wirtschaftsstabilisieroungsfonds), which is still subject to approval by the Commission. We do not include the €100 billion allocated to support KfW in case it fails to raise funds on capital markets, which has not been activated.[↩]

- We were not able to collect figures in all German regions (Länder). Based on observations in some Länder, we estimate that, taken together, German regional credit support via regional development banks (Landesförderinstitute) amounts to a maximum of €10 billion. Other regional guarantee programmes, e.g. via regional guarantee banks (Bürgschaftsbanken), combine to an additional €2bn (as of June 20, 2020). Regional programmes also exist in other countries, e.g. in Italy, but we estimate them to be comparatively small.[↩]

- The Spanish guarantee programme on promissory notes has an allocated envelope of €4bn. For simplicity, the smaller €0.5bn counter-guarantee programme (provided to mutual guarantee societies by the Compañía Española de Reafianzamiento S.A., or CERSA) is not discussed here.[↩]