Some 30 years ago Thomas Sargent and Neil Wallace published an article [1] that raised the possibility of tight monetary policy leading to inflation. Salvatore Rossi and I showed that this result was due to a questionably formulated public budget constraint in their model [2] and basically salvaged the traditional result that it is loose monetary policy that leads to inflation.

The link between that old story and Quantitative Easing is that there is something unpleasant about Quantitative Easing arithmetic, at least for those market observers that, with some justification, interpret recent ECB message as pre-announcement of some exercise of this sort.

The overall reasoning of this post can be summarized in 4 points:

1.If the ECB would engage in QE in sizes similar to those of the FED, the Bank of England and the Bank of Japan, it would have to buy trillions of assets [3];

2.There are only two asset classes in the €-area that would allow purchases of this size, sovereign bonds and bank loans;

3.The ECB seems to dislike the purchase of sovereign bonds and it is really difficult to envisage, for all sort of reasons, purchases of trillions of bank loans;

4.The only way to surpass the limit stressed in the previous point would be the purchase of a portfolio of different assets. This was, after all, the announced decision for the Securities Market Program, which was not in principle limited to sovereign bonds, even if, in practice, only these assets were purchased. Also the Bank of Engand and the Bank of Japan could buy in principle non sovereign assets, but the lion share of these purchases were of sovereign bonds. The same would need to apply to an ECB QE.

Let see these points one after the other.

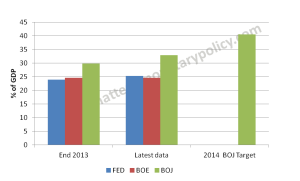

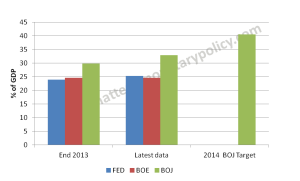

Chart 1 reports the size of QE purchases by the FED, the Bank of England and the Bank of Japan as a share of the relevant GDP. Here one sees that these central banks have bought, or plan to buy by the end of the program, assets representing shares between20 and 40 % of their GDP. The figures in billion € for the three central banks are reported in Table 1. In this table also the amounts of assets the ECB would have to purchase to reach the same amounts, in per cent of GDP, of the three other central banks are reported. In particular the ECB would have to carry out a program of purchases between approximately 2 and 4 trillion € to match the size, in per cent of GDP, of the US, UK and Japan central banks.

Chart 1: Size of central bank asset purchases

|

Source: Central bank balance sheets, IMF WEO Oct 2013

Note: Size of QE defined as stocks of MBS and US Treasuries in the case of FED; Gilts in the case of BOE; JGBs, Commercial paper, Corporate bonds, ETFs, J-REITs and LSP in the case of BOJ. |

Table 1: EUR equivalent of central bank asset purchases

Source: Central bank balance sheets, IMF WEO Oct 2013

Table 2 present the stocks of different assets available in the €-area: sovereign securities, covered bonds, bank bonds (senior and junior), corporate bonds, Asset Backed Securities (total and the component with SME loans as underlying), bank loans (total and the component used as collateral with the ECB).

Table 2: Size of possible intervention markets

( As of end 2013, EUR bn, EUR denominated stocks )

Source: ECB, AFME, Barclays research

Source: ECB, AFME, Barclays researchThe unpleasant arithmetics appear immediately confronting the two tables: the only assets which would allow purchases of the order of magnitude estimated in table 1 would be sovereign bonds and total bank loans (excluding that the ECB would want to buy between 50 and 100% of bank bonds!).

However, Draghi in his latest press conference hinted at a reluctance to purchase large amounts of sovereign securities [4].

As regards bank loans, a comparison between the total amount of these assets(10 500 billion) and the amounts used as collateral for ECB refinancing (500 billion, i.e. 5 % of the total) synthetically illustrates the problem: if the ECB, many years after having accepted bank loans as collateral across the €-area and after having (more than 2 years ago, in December 2011) relaxed the criteria for their use, can only take 5 % of them as collateral, could it carry out a program where it would need to buy 4 or 8 times as many assets? The problems that would stand in the way of huge purchases of bank loans, and that stood in the way of a larger amount of them being used as collateral, are the following:

1.Assessing the credit quality of bank loans is a very complicated issue and, notwithstanding the plurality of assessing tools accepted by the ECB,[5] it was not possible to further increase the amount of bank loans used as collateral,

2.There is no market (leave alone a liquid one) for bank loans, as demonstrated by the fact that the ECB has 5 liquidity categories for its marketable collateral, with the haircut for AAA assets having a maturity longer than 10 years growing from 10.5% for category 1 to 16% for category 5, while bank loans of same duration and credit quality, for which no liquidity category is foreseen, have a haircut of 20.5%;

3.Because of an absent market, it would be very difficult to establish at which price the loans would have to be bought by the ECB.

4.The ECB just does not have the capacity to manage a portfolio of hundreds of billions, leave alone trillion, of bank loans, arguably until maturity.

If the ECB does not like buying huge amount of sovereign securities, if the purchase of bank loans in large amounts does not look possible and the other asset segments in the €-area are just too small for purchases in QE size, what are the practical possibilities of implementing QE in the €-area? Of course, one could think of mixed purchases [6] whereby the ECB could buy a portfolio of different asset classes. Given the considerations above, however, I do not see how the ECB could avoid buying predominantly government securities, as did all the other central banks considered above, with the partial exception of the FED that could implement large purchases of Mortgage Based Securities.

In conclusion, in addition to the questions I raised in another post [7] about the desirability of QE in the €-area, this kind of measure would encounter big problems in operational terms, unless it was largely carried out in the sovereign market.

Adding to my doubts about an imminent implementation of this program, there is an issue of sequencing. The ECB has refused for the last 5 months, notwithstanding the nearly unanimous choir asking for action, to take any measure, even the milder among the seven I mentioned in a previous post [8]. Now, instead, it would move to the boldest, and arguably the most controversial, of the measures it could take. Would it not be more natural to start with the milder measures and commit to take the others, in a sequence of strengthening effect, in a new form of forward guidance? Would this not better consolidate inflationary expectations, that are gradually loosing their anchor [9] and exert a more permanent downward effect on the exchange rate, whose strength risks further impairing the achievement of inflation control? In this sequence a targeted action on ABS would fit very well, but only a stretch of imagination could call it QE.

Still, I recognise that there have been a number of messages from the ECB raising expectations of some QE coming. Let´s see whether these expectations will be fulfilled.

–———————————-

*** Madalina Norocea provided research assistance

[1] Sargent T. J. and N. Wallace, 1981, Some unpleasant monetarist arithmetic, Federal Reserve Bank of Minneapolis Quarterly Review 4, 1-17

[2] F. Papadia and S. Rossi, 1989, More on monetarist arithmetic, Journal of Banking and Finance 14 (1990), 145-154

[3] The leak that appeared in the Frankfurter Algemeine Zeitung on 4th of April 2014 talked about simulations carried in the ECB about the purchase of 1 trillion of assets

[4] ” It is a question of how to design QE considering that our institutional and financial set-up is considerably different from what it is in the United States, for example. In our case, the economy is based on the bank lending channel and therefore the programme has to be carefully designed in order to take this element into account.”

[5] See Chapter 6.3.3 of Guideline of the European Central Bank on monetary policy instruments and procedures of the Eurosystem

[6] Speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the high-level conference on “Monetary Policy in the New Normal” organised by the IMF Washington D.C., 13 April 2014

[7] Should the ECB go quantitative?

[8]Is the price stability target of the ECB at risk?

[9]From firmly to weakly anchored, or the importance of an adverb!

Well, I guess that any trader could take advantage from these pre-announcement actions from ECB, BOE or BOJ. Interesting details here in the post by the way!

What about buying equities? Much as I dislike the idea of the central bank buying equities and owning a large chunk of the stock market anywhere, there are a number of advantages, to wit:

You get away from the politics of buying sovereign debt

You don’t pick winners – you buy an index (eg, STOXX600)

The market is big enough

If you succeed and the economy eventually recovers, you can sell the shares at a profit (pretty much irrelevant, I know, but it looks good)

You can avoid exercising ownership by keeping the shares in an escrow account, so to speak

Best of all – since shares tend to be owned by the non-bank private sector, there is an immediate impact on broad money